Portal:Real Economy Project

The Real Economy Project Portal

Toxic Assets Getting You Down?

|

This article is part of the Real Economy Project. Take action at BanksterUSA.org. |

In 2008, the big banks on Wall Street blew a hole in the economy that will take many years to repair. This is the portal page to a collection of editable wiki profiles of the bankers, financial companies, lobbyists, and front groups who contributed to the financial crisis or benefited from the bank bailout. Help us build this library by visiting the "Help Out" section below. Don't let the Banskters write the history of this tumultuous time in America!(About/contact)

Financial Crisis News

Having Problems with Your Bank or Mortgage? Time to Talk to the Consumer Financial Protection Bureau

January 9, 2013

The CFPB began taking consumer complaints about credit cards on July 2011; it began handling [https:/help.consumerfinance.gov/app/mortgage/ask mortgage complaints] on December 2011; and it began accepting complaints about bank products and services, private student loans, and other consumer loans on March 2012. Throughout 2013, the CFPB expects to handle consumer complaints on all products and services under its authority. Other areas in which the agency is expected to act include overdraft fees, which are charges banks levy when more money is withdrawn from an account than it contains; debt collectors, and credit-reporting firms, which the CFPB began supervising January 2013.

Consumer advocates overcame stiff opposition from the financial services industry to require that the Bureau develop a unique public database of consumer complaints. The easy-to-use database allows consumers to document and seek redress for a wide range of complaints regarding financial service providers and allows regulators to spot trends and target abusive industry practices with new regulations.

TO FILE A COMPLAINT with the CFPB go here.

TO SEE COMPLAINTS that have been filed go here.

That Bad Ceiling Feeling: Unlike the Fiscal Cliff the Debt Ceiling Is the Real Deal

January 8, 2013

Missing the fiscal cliff? Don't know what to talk about at the dinner table?

Get ready, the Bipartisan Policy Center has predicted that on February 15, 2013, the U.S. Treasury will take in an estimated $9 billion in revenue, but is committed to pay out $52 billion.

Yup, that's right. The debt ceiling is upon us again and Republicans are showing every sign that they will once again attempt to hold the country hostage to force a "grand bargain" they hope will result in major cuts to Social Security and Medicare.

Read the rest of this item here.

It Ain't Over Till It's Over: Wall Street Gears Up for Austerity Battles of 2013

January 2, 2013

For better or worse, a bill passed Congress in the wee hours of 2013 averting the much-hyped "fiscal cliff" for now and raising taxes on couples making over $450,000 and extending a lifeline of unemployment benefits to 2 million Americans.

But the vote is not so much an ending as a beginning to the austerity battles of 2013.

Read the rest of this item here.

It's Time For a Robin Hood Tax!

August 17, 2012

Reckless Wall Street gambling collapsed the global economy, and we are still reeling. Politicians claim America is "broke" to justify layoffs and drastic cuts to critical services. But we're not broke. Robin knows where the money is. A tiny tax on Wall Street will generate billions to help Main Street get back on the road to recovery.

More News on Financial Crisis

Latest articles from the Center for Media and Democracy's PR Watch about banking, financial issues and the economy:

- This Earth Day, Stop the Money Pipeline

- PRWatch Editors 2020-04-23 12:47:55

- Conservative Foundations Finance Push to Kill the CFPB

- Alex Kotch 2020-02-13 15:32:47

- Fox in the Henhouse: Koch-Backed Opponent of Consumer Financial Protection Bureau Chairs Taskforce to Evaluate Its Regulations

- David Armiak 2020-02-11 02:18:00

- Kochs Drop Millions for Walker, Back Republicans Across the Ballot in Wisconsin

- David Armiak 2018-08-22 19:54:49

- Bernie Sanders' Plan to Tame Wall Street Riles Team Clinton

- Mary Bottari 2016-01-06 15:49:10

- The Wall Street Bonus Pool and Low-Wage Workers

- PR Watch Admin 2015-03-12 16:11:21

- Congress to Reinstate Taxpayer Subsidies for Reckless Derivatives Trading

- Mary Bottari 2014-12-11 17:28:09

- Failing Up to the Fed, A Reporters' Guide to the Paper Trail Surrounding Larry Summers

- Mary Bottari 2013-09-03 12:35:02

- "Operation Tripwire" -- the FBI, the Private Sector, and the Monitoring of Occupy Wall Street

- Beau Hodai 2013-05-24 13:12:16

- The Homeland Security Apparatus: Fusion Centers, Data Mining and Private Sector Partners

- Beau Hodai 2013-05-22 12:45:49

Wall Street Bailout Resources

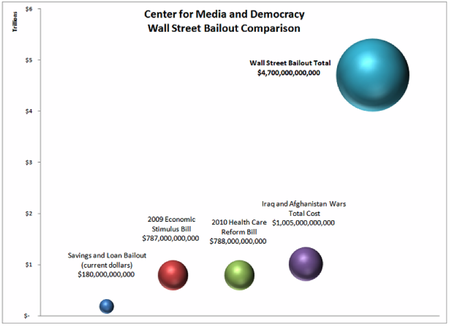

The Center for Media and Democracy produced a Wall Street Bailout Tally of all 35 Federal Reserve and Treasury Department programs. While, the mainstream media focuses on the $700 billion TARP bailout bill and its related programs, the actual tally is closer to $4.7 trillion -- yes trillion with a "t". Check out our tally here. The Bailout Bubble graph below puts this number in perspective.

Bloomberg News did a series of Freedom of Information Act requests of the Federal Reserve about their back door bailouts of financial institutions at the height of the financial crisis. Their article "Secret Fed Loans (of $7.7 trillion) Gave Banks $13 Billion (profits) Undisclosed to Congress" is long but a must read. They also have some specific databases that allow for bank by bank research.

CMD'S WALL STREET BAILOUT CHART

BLOOMBERG: BANK BY BANK BAILOUT TOTALS VISUALIZATION TOOL

Bubble Graph Comparing the Wall Street Bailout to S&L Bailout, "Obamacare," and Obama Stimulus Bill

References for the statistics in the chart:

This chart and an article by CMD's Mary Bottari was featured in Dollars and Sense Magazine.

The S&L Crisis (audited RTC statements adjusted to 2010 dollars)[1]

Track the Recovery Money[2]

The CBO's Estimated Health Reform Cost[3]

Cost of U.S. Wars in the Middle East[4]

Total Wall Street Bailout Cost (see above)

This chart and an article by CMD's Mary Bottari was featured in Dollars and Sense Magazine.

The S&L Crisis (audited RTC statements adjusted to 2010 dollars)[1]

Track the Recovery Money[2]

The CBO's Estimated Health Reform Cost[3]

Cost of U.S. Wars in the Middle East[4]

Total Wall Street Bailout Cost (see above)

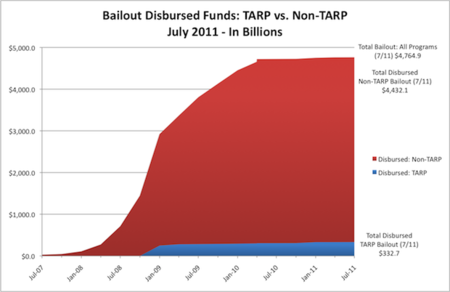

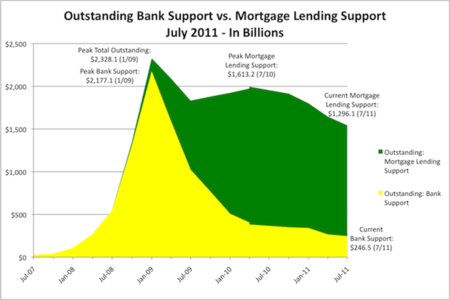

TARP Bailout Vs. Federal Reserve Bailout

These graphs were produced by the Center for Media and Democracy. The first shows the TARP bailout, which was voted on by Congress in October 2008, compared to the backdoor (Non-TARP) bailout by the Federal Reserve, which was never subjected to a Congressional debate or a vote. The second chart shows that the vast majority of Federal Reserve money has gone to purchases of mortgage backed securities, a practice that was continuing into 2013. See more here.

CMD's Press Releases Related to the Bailout

- Money Still Owed In Federal Bailout, July 2011

- Taxpayers Still Out $2 Trillion, September 2010

- Homeowners Get No Help From TARP, July 2010

- Bubbles and Bailouts, June 2010

- Stealth Bailout Underway, May 2010

- Bailout Focus on Housing, April 16, 2010

- CMD Bailout Press Release, April 1, 2010

- Key Findings from CMD Bailout Report, April 1, 2010

Help out!

The Real Economy Project needs volunteers to help document the people and policies behind the financial crisis and bank bailout. Help can be found at "welcome, newcomers!"; the main help page; and the FAQ.

Project contents

Pages of interest:

- Elizabeth Warren

- Consumer Financial Protection Agency

- Goldman Sachs

- Lehman Brothers

- JPMorgan Chase

- Bank of America

- The "plutonomy memos" from Michael Moore's movie, Capitalism, A Love Story

- Financial crisis and bank bailout resources

Portals: Koch Exposed · FrackSwarm · CoalSwarm · OutsourcingAmericaExposed · ALECexposed · NFIBexposed · Fix the Debt · State Policy Network · All Portals