Roadmap for America's Future

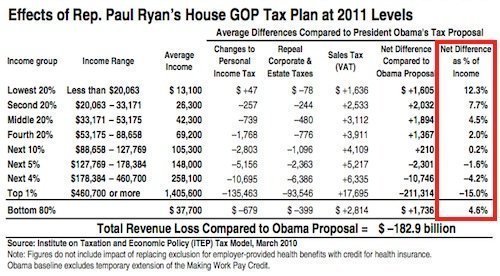

In 2010, Wisconsin Rep. Paul Ryan (R-1) introduced the budget deficit plan A Roadmap for America's Future. The plan included privatizing social security and ending traditional Medicare and most of Medicaid, an across-the-board income tax cut, and reducing or eliminating taxes in the areas most likely to benefit the wealthiest members of society (capital gains, estate taxes,and the alternative minimum tax). The top 1 percent of income earners would see their overall taxes cut in half, and between 90 and 95% of the rest of the population would actually see their taxes increase. [1]

Despite raising taxes on the vast majority of Americans and severely cutting social programs, the plan is estimated to result in a budget deficit of between $1.3 and 2 trillion over the next decade. [2] [3]

The Washington Post's Ezra Klein has said "Ryan's Roadmap . . . is a timebomb for [the Republican party]: It doesn't just privatize Medicare, but it holds costs down by giving seniors checks that won't keep up with the price of health care. It privatizes much of Social Security. It cuts taxes on the rich while raising them on many in the middle class." [4]

See also Paul Ryan

Contents

Roadmap's Impact on the Deficit

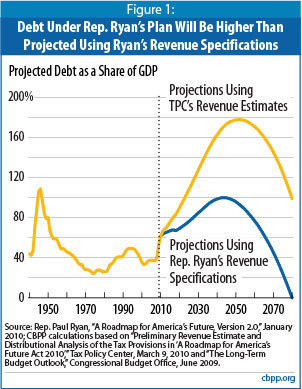

While some media reports have claimed that the Congressional Budget Office (CBO) estimated that the Roadmap would cut the budget deficit in half by 2020, Paul Krugman pointed out that the CBO only "produced an estimate of the budget effects of his proposed spending cuts — period. It didn’t address the revenue losses from his tax cuts."[2]

The Joint Committee on Taxation, not the CBO, produces estimates of the effect of tax policies on revenue; in producing its estimate, the CBO used numbers produced by Rep. Ryan’s staff that overall revenues would not change (despite major tax cuts), and would equal 19 percent of GDP in later years. A July 2010 analysis by the nonpartisan Urban Institute-Brookings Institution Tax Policy Center (TPC) estimates that Ryan's plan would reduce revenue by almost $4 trillion over the next decade, which combined with the spending cuts, would result in a deficit nearing $1.3 trillion by 2020. Adjusted for revenue losses, TPC estimates the budget deficit would grow to 7 percent of GDP and the debt would grow to 90 percent of GDP by 2020; revenues under the Ryan plan would average 16.3 percent of GDP over the period from 2011 through 2020.[5]

Tax Cuts

The Tax Policy Center found that the plan "would cut taxes on the richest 1 percent of the population in half, giving them 117 percent of the plan’s total tax cuts. . . Even as it slashed taxes at the top, the plan would raise taxes for 95 percent of the population." [2] The Economic Policy Institute found that, when all tax cuts are taken into account, Ryan’s plan would allow the overall tax rate for the middle-class to be higher than the rate for millionaires. [1]

The Roadmap would eliminate the Alternative Minimum Tax, and eliminate income taxes on capital gains, dividends, and interest.[6] These reforms would primarily help persons in top income brackets, who derive most of their income from capital and investment income; the Roadmap claims this would promote "more investment and higher rates of productivity." [6]

The plan would do away with the current tax system's six tiers, and replace them with only two tiers: (1) 10 percent rates on adjusted gross income up to $100,000 for joint filers, and $50,000 for single filers, and (2) 25 percent on taxable income above these amounts. When the elimination of the capital gains tax is taken into account, millionaires would see their average tax rate drop to 12.8%, less than half of what they would pay relative to current policy. [1] Middle-class families earning between $50,000 and $75,000 a year would see their average tax rate jump to 19.1% (from 17.7%).[1]

Rep. Ryan's Roadmap would also do away with the corporate income tax and replace it with an 8.5% "business consumption tax" (calculated and administered based on the "subtraction method," whereby a business determines its tax liability by subtracting its total purchases from its total sales).[6] Some argue that this resembles a Value Added Tax [VAT], such as those in European countries, but Roadmap proponents insist it is different. [7] Others believe that the business tax would ultimately be passed to consumers in the form of higher prices, thereby placing more of a burden on the middle class than the wealthy. [8]

The plan also caps what it calls the "tax burden" at 19% of GDP, meaning that government revenues cannot exceed 19% of the overall economy's GDP. [6] The Tax Policy Center has taken issue with this estimation. [5]

EPI’s Andrew Fieldhouse concluded, under the Roadmap, “a long tradition of progressive taxation would be abandoned; millionaires and Wall Street bankers would pay significantly lower tax rates than middle-class workers… Income inequality would soar.”[1]

Entitlement Program Cuts

The Roadmap's major spending cuts would eliminate Medicaid and the State Children's Health Insurance Program, and revamp Medicare by promoting private insurance through a voucher program.

The plan aims to move away from government-sponsored insurance by promoting individual ownership of private insurance through vouchers. The Roadmap website claims that the health care market is distorted by the current employer-based system, which is propped up by the individual income tax exclusion for employer-sponsored health care.[9] Instead, the Roadmap would aim to shift payment for health care from third parties (i.e. employers) to individuals, offering a refundable tax credit – $2,300 for individuals and $5,700 for families – to pay for health coverage. [9]

Medicaid

Medicaid would be eliminated and replaced with a system that "provides beneficiaries with health care debit cards with adjustable fund amounts, and allows recipients to combine these amounts with support from the health care tax credit."

Medicare

The voucher program would also be applied to Medicare in order to push more seniors towards private insurance, and dismantle the program as it currently exists. Krugman asks:

- "Does this sound familiar? It should. It’s the same plan Newt Gingrich tried to sell in 1995.

- And we already know, from experience with the Medicare Advantage program, that a voucher system would have higher, not lower, costs than our current system. The only way the Ryan plan could save money would be by making those vouchers too small to pay for adequate coverage. Wealthy older Americans would be able to supplement their vouchers, and get the care they need; everyone else would be out in the cold.""[2]

By 2080, under Ryan's plan, the Medicare program would be reduced by nearly 80 percent below its projected size under current policies. The Center on Budget and Policy Priorities states that the Roadmap's cuts "would be so severe that CBO estimates they would shrink total federal expenditures (other than on interest payments) from roughly 19 percent of GDP in recent years to just 13.8 percent of GDP by 2080. Federal spending has not equaled such a low level of GDP since 1950, when Medicare and Medicaid did not yet exist, Social Security failed to cover many workers, and close to half of the elderly people in the United States lived below the poverty line."

Social Security

The Center on Budget and Policy Priorities (CBPP) states that "the Ryan plan proposes large cuts in Social Security benefits -- roughly 16 percent for the average new retiree in 2050 and 28 percent in 2080 from price indexing alone." It "initially diverts most of these savings to help fund private accounts rather than to restore Social Security solvency." [10]

The Roadmap website states that "individuals will be able to join the investor class for the first time" through "the creation of personal investment accounts for future retirees" that are "the property of the individual."

Lukewarm Republican Response

The many controversial and politically unpopular elements of the plan have led GOP leadership to avoid publicly supporting it.

During the midterm election campaign, the GOP dropped Ryan's Roadmap from its "Pledge to America." [11]

The conservative National Review noted that "praise for the Wisconsin Republican comes easy and often, full-scale endorsement of the roadmap less so. . . Nevertheless, with Ryan now holding real power, along with a burgeoning national profile, Republicans will be forced to choose how aggressively to act on his big ideas — even if it makes them uncomfortable." [12] Majority Leader Rep. Eric Cantor (R-VA), House Speaker John Boehner, and many other Republicans have not fully endorsed the plan. [12] Majority Leader Eric Cantor (R-VA) said he supports only "elements" of the plan, but said on NBC's Meet the Press that "we need to embrace" its direction. And last year, Boehner wouldn't endorse the Roadmap, but at the same time couldn't name any specific part he disagreed with.

Earlier versions of the "Roadmap"

Rep. Ryan introduced the first roadmap, "Roadmap for America's Future Act of 2008" (H.R. 6110) on May 21, 2008. The plan did not move past committee. [13]

On April 1, 2009, Rep. Ryan introduced the "GOP's Alternative Budget" to contrast with President Obama's 2010 budget (saying that if Obama's "agenda comes to pass, it will mark this period in history as the moment America turned European.") [14] Opponents criticized the budget for lacking concrete numbers, and it was rejected in the House by a vote of 293-137, with 38 Republicans voting against the bill. [15]

References

- ↑ 1.0 1.1 1.2 1.3 1.4 Andrew Fieldhouse, Paul Ryan's Plan for Millionaires' Gain and Middle-Class Pain, Economic Policy Institute, January 19, 2011.

- ↑ 2.0 2.1 2.2 2.3 Paul Krugman, The Flim-Flam Man, NYTimes, August 5, 2010.

- ↑ Rep. Ryan's House GOP Budget Plan, Citizens for Tax Justice, March 9, 2010.

- ↑ Ezra Klein, Did Republicans Just Take Ownership of Ryan's Roadmap?, Washington Post, January 21, 2011.

- ↑ 5.0 5.1 Paul N. Van de Water, The Ryan Budget's Radical Priorities, Center on Budget and Policy Priorities, July 7, 2010.

- ↑ 6.0 6.1 6.2 6.3 Roadmap for America website, accessed January 22, 2010.

- ↑ Roadmap for America website, Roadmap Q&A, accessed January 22, 2011.

- ↑ Mark Ambinder, If Paul Ryan's Roadmap Is the Republican Way, Why Aren't Republicans Driving On it?, The Atlantic, March 11, 2010.

- ↑ 9.0 9.1 Roadmap for America website, "Health Security", accessed January 22, 2010.

- ↑ Paul N. Van de Water, The Ryan Budget's Radical Priorities, Center on Budget and Policy Priorities, July 7, 2010.

- ↑ Rick Newman, 4 Things Missing from the Pledge to America, US News, September 28, 2010.

- ↑ 12.0 12.1 Robert Costa, A Roadmap Not Taken?, National Review, January 17, 2011.

- ↑ H.R. 6110: Roadmap for America's Future Act of 2008. United States Congress. Government Printing Office.

- ↑ Paul D. Ryan, The GOP's Alternative Budget, Wall Street Journal, Apr. 1, 2009.

- ↑ 38 Republicans Vote Against GOP's Alternative Budget, Newsmax, April 2, 2009, accessed January 22, 2011.