Wage Theft

Wage theft refers to the failure of an employer to pay workers the wages they are owed. For workers, wage theft might include "being paid less than the minimum wage or other agreed upon wage, working 'off-the-clock' without pay, getting less than time-and-a half for overtime hours, having tips stolen, being misclassified as an “independent contractor” instead of an employee and underpaid, having illegal deductions taken out of paychecks, or simply not being paid at all," according to the National Employment Law Project.[1]

Wage theft is widespread in the United States. A 2008 UCLA/UIC study of low-wage workers in large cities found that two thirds had been affected by some form of wage theft. Of those surveyed, 26% had been paid less than the minimum wage in the previous week, and 76% of those who worked over 40 hours had not been paid sufficient overtime.[2]

While low-wage service sector employees and immigrant workers may be the most vulnerable, wage theft affects workers at all levels. Even software engineers are not immune, as evidenced by a class action lawsuit brought against Google, Apple, Intel, and Adobe in 2010.[3] The suit was settled in 2014 for $324 million.[4]

Federal contractors have also repeatedly violated wage laws, according to a 2013 report by the U.S. Senate Health, Education, Labor, and Pensions Committee. Between 2007 and 2012, 32 contractors received back wage assessments that were among the 100 largest made by the Wages and Hours Division of the U.S. Department of Labor. In that period, "the 49 federal contractors responsible for large violations of federal labor laws were cited for 1,776 separate violations of these laws and paid $196 million in penalties and assessments"--with the same companies receiving $81 billion in federal contracts in 2012 alone.[5]

A 2014 report by the Economic Policy Institute found that in terms of the amount of money stolen, "[w]age theft is a far bigger problem than bank robberies, convenience store robberies, street and highway robberies, and gas station robberies combined." For example, the Kentucky Labor Cabinet calculated that more than twice as much money was withheld through wage theft than taken in robberies in Kentucky between 2011 and 2013.[6] In 2012, about $139 million was stolen in robberies in the U.S., while the U.S. Department of Labor recovered $280 million in wages illegally withheld, likely only a fraction of total wage theft that year.[7] In her 2008 book, Wage Theft in America, Kim Bobo estimated that employers net $100 billion or more per year from wage theft.[8]

Contents

- 1 U.S. Department of Labor, Wage and Hour Division (WHD)

- 2 National Organizations Fighting Wage Theft

- 3 State and Local Organizations Fighting Wage Theft

- 4 ALEC Bills Related to Wage Theft

- 5 News and Lawsuits

- 5.1 Car Washes

- 5.2 Construction, Day Labor, and Landscaping

- 5.2.1 Construction Firms in New York City Get Millions in Tax Breaks Despite Allegations of Wage Theft

- 5.2.2 Study Finds "Epidemic" of Misclassification and Wage Theft in MA Construction, 2015

- 5.2.3 Rampant Misclassification on Federal Stimulus Projects, 2009-2014

- 5.2.4 San Francisco Painting Contractor Charged with Wage Theft and Insurance Fraud, 2012

- 5.2.5 CA Concrete Company Charged with Evading Payroll Taxes, Workers' Comp Fraud, 2010

- 5.3 Hospitality Industry

- 5.3.1 Investigation Finds "Rampant" Violations in North Texas Hotel Industry, 2015

- 5.3.2 Workers Stage Campaign Against Darden Restaurants, 2012-2014

- 5.3.3 McDonald's Workers in Three States File Lawsuits Alleging Wage Theft, 2014

- 5.3.4 Subway Franchisee Allegedly Created Fake Workers to Avoid Paying Overtime, 2014

- 5.3.5 Lawsuit Filed Against McDonald's over High-Fee Payroll Debit Cards

- 5.3.6 Indianapolis Hotel Workers Reach Settlement with Hospitality Staffing Solutions, 2012

- 5.3.7 Queens Restaurant Guilty of Failing to Pay Minimum Wage, Retaliation, 2012

- 5.4 Personal Care and Service

- 5.5 IT Industry/Silicon Valley

- 5.6 "Task Sharing" Startup Sued for Misclassifying Workers, Violating Minimum Wage, 2014

- 5.7 Retail

- 5.7.1 Immigrant Grocery Workers Win $305,000 Settlement for Wage Theft, 2015

- 5.7.2 Janitors Contracted to Clean Macy's, Herberger's File Suit Alleging Wage Theft, 2015

- 5.7.3 Walmart Ordered to Pay $188 Million in Wage Theft Lawsuit, 2014-2015

- 5.7.4 Wal-Mart Settles Another Wage Violation Complaint, 2012

- 5.7.5 Staples Settles Lawsuit Over Misclassifying Employees, 2010

- 5.7.6 Wal-Mart Settles 63 Wage Violation Lawsuits, 2008

- 5.8 Transportation

- 6 Policy Responses to Wage Theft

- 7 List of State and Local Legislation Related to Wage Theft

- 7.1 Connecticut SB 914, 2015

- 7.2 California SB 588, 2015 (proposed)

- 7.3 Colorado Wage Protection Act, 2014

- 7.4 Oregon HB 2977B, 2013

- 7.5 Maryland Lien for Unpaid Wages, 2013

- 7.6 New York Wage Theft Prevention Act, 2011; Task Force to Combat Worker Exploitation, 2015

- 7.7 California Wage Theft Protection Act, 2011

- 7.8 Illinois Wage Payment and Collection Act, 2011

- 7.9 New Mexico HB 489, 2009

- 7.10 Wage Theft Prevention Act, Washington, D.C., 2014

- 7.11 Anti-Wage Theft Ordinance, Chicago, IL, 2013

- 7.12 Wage Theft Prevention Act, New York City, NY, 2010

- 7.13 Wage Theft Ordinance, Miami-Dade County, FL, 2010

- 8 Reports and Additional Resources

- 9 References

U.S. Department of Labor, Wage and Hour Division (WHD)

The Wage and Hour Division (WHD) of the U.S. Department of Labor is charged with enforcing "Federal minimum wage, overtime pay, recordkeeping, and child labor requirements of the Fair Labor Standards Act," as well as "the Migrant and Seasonal Agricultural Worker Protection Act, the Employee Polygraph Protection Act, the Family and Medical Leave Act, wage garnishment provisions of the Consumer Credit Protection Act," as well as prevailing wage requirements for federal government contracts, including under the Davis Bacon Act and the Service Contract Act.[9]

The WHD is responsible for investigating worker complaints about violations of these acts, including wage theft. In 2014, The Nation wrote that "Historically, the bulk of Wage and Hour’s enforcement activity was investigating individual complaints—a strategy that amounted to a game of whack-a-mole, considering that the DOL has only 1,100 investigators to oversee 135 million workers in more than 7 million businesses."[10]

The WHD website includes resources about labor law, along with instructions in at least ten languages for filing complaints.

WHD Issues Guidance Letter on Worker Misclassification and Independent Contractors, 2015

WHD Administrator David Weil issued a guidance letter in July 2015 clarifying which workers should be properly classified as employees, rather than independent contractors. As described by the Chicago Tribune, the guidance letter

- reminds employers that under the Fair Labor Standards Act, most workers are employees because it broadly defines "employ" as "to suffer or permit to work." The department says employers should use the "economic realities test," which focuses on whether a worker is economically dependent on the employer and takes into account several factors, such as the degree of control imposed on the worker and the worker's ability to profit. The department said the factors must be considered as a whole and not in isolation.[11]

In a blog post, Weil noted that "[w]hether a worker is an employee under the Fair Labor Standards Act is a legal question determined by the economic realities of the working relationship between the employer and the worker, not by job title or any agreement that the parties may make. The Labor Department supports the use of legitimate independent contractors − who play an important role in our economy − but when employers deliberately misclassify employees in an attempt to cut costs, everyone loses."[12]

New WHD Administrator to Focus on Low Wage Industries, 2014

In May 2014, Boston University economist David Weil became the new administrator of the WHD.[13] Weil, who spent his academic career research workplace issues, is the first permanent administrator in a decade.[14]

In an interview with The Nation, Weil described the agency's two main challenges as its own lack of resources and the ongoing trend of companies relying increasingly on third-party contractors and franchising.[10] These practices can enable unscrupulous corporations to evade responsibility for labor law violations committed by third party companies.[14] "Although the department will still respond to individual complaints, Weil is directing the bulk of his resources to targeted investigations in industries and sectors where labor exploitation is endemic. Those industries tend to employ many low-wage, low-skill or undocumented workers," according to The Nation.[10]

Government Accountability Office Finds WHD Responses Inadequate, 2009

In 2008 and 2009, the U.S. Government Accountability Office investigated concerns about the WHD's failure to investigate some claims, concluding "that WHD frequently responded inadequately to complaints, leaving low wage workers vulnerable to wage theft." The investigation included GAO officers filing ten fictitious complaints with the WHD and analyzing its responses. According to the GAO's report, "The undercover tests revealed sluggish response times, a poor complaint intake process, and failed conciliation attempts, among other problems," including failure to undertake any investigation of three of the ten cases. Nine out of the ten cases were found to have been mishandled.[15]

In response, Secretary of Labor Hilda L. Solis told the New York Times that "she took the report’s findings seriously" and that "the Wage and Hour Division planned to increase its staff by a third by hiring 250 investigators — 100 of them as part of the federal stimulus package."[16]

National Organizations Fighting Wage Theft

Interfaith Worker Justice (IWJ)

Based in Chicago, Interfaith Worker Justice (IWJ) organizes a national network of faith communities, workers, and student groups in support of workers' rights.[17] IWJ was founded in 1996 by Kim Bobo, who continues to serve as its executive director.[18]

Bobo wrote the 2009 book "Wage Theft in America," which a review by MIT's Institute for Work and Employment Relations described as an "in-depth analysis of an issue that we all know occurs but that little has been written about."[19]

IWJ has around 70 affiliate interfaith and worker groups across the U.S., including Fe y Justicia Worker Center in Texas and the Interfaith Coalition for Worker Justice in Wisconsin.[20]

IWJ's website is http://www.iwj.org/.

Jobs With Justice

Jobs With Justice is a national network that focuses on "bringing together labor, community, student, and faith voices at the national and local levels."[21] It also conducts research, provides resources for activists, and engages with the press on workers' rights and economic justice issues.

Jobs With Justice was founded in 1987 and merged with American Rights at Work in 2012.[22] It has affiliates in at least 22 states and the District of Columbia.[23]

Jobs With Justice's website is http://www.jwj.org/.

National Employment Law Project (NELP)

The National Employment Law Project (NELP) provides research, policy advising, legal assistance, coalition leadership, and public education related to workers' rights. NELP has offices in New York City, Washington D.C.; Oakland, CA; Seattle, WA; and Ann Arbor, MI.[24]

NELP was founded in 1974 to provide legal services for the working poor and the unemployed, and was funded by the federal government until 1994.[25]

NELP's website is http://www.nelp.org/.

Progressive States Network (PSN)

The Progressive States Network (PSN) "engages and builds the capacity of state and national leaders to advance public policy solutions that uphold America’s promise to be a just and equitable democracy."[26] PSN connects progressive state legislators around the U.S., promotes progressive policies on issues such as the economy, immigration, and election reform, and produces research reports on its issue areas.

PSN is a contributor to the American Legislative and Issue Campaign Exchange (ALICE), which produces progressive model legislation for state and local governments.[27] According to The Nation, ALICE is meant to be "a counterforce to ALEC," the American Legislative Exchange Council.[28]

PSN's website is http://www.progressivestates.org/.

ROC United

ROC United, whose full name is Restaurant Opportunity Centers United, focuses on wages and working conditions for restaurant workers around the U.S. ROC United was formed in 2008, while its predecessor, ROC-New York, was founded in 2001 "to provide support to restaurant workers displaced as a result of the World Trade Center tragedy."[29] ROC has local affiliates in many cities around the U.S., including New York, Chicago, Los Angeles, Houston, New Orleans, Philadelphia, and Washington D.C.[30]

Among ROC United's campaigns is "Dignity at Darden," which calls for better working conditions at restaurants run by the Darden Group, including Capital Grille, Red Lobster, Olive Garden, and Longhorn Steakhouse.[31]

ROC United's website is http://rocunited.org/.

Working America

Working America is an affiliate of the AFL-CIO which addresses workplace rights and employment issues, as well as other areas that affect working families such as health care, retirement benefits, and education[32] The Nation calls Working America the "largest non-union workers’ group" in the U.S.[33] One of Working America's major activities is organizing workers who do not have a workplace union, including through door-to-door canvassing.[34]

As of July 2014, Working America had offices in 12 states and was active in 14 others. According to The Nation, Working America aims to have chapters in all 50 states by 2018.[33]

Working America's website is http://www.workingamerica.org/.

State and Local Organizations Fighting Wage Theft

Make the Road New York (New York City)

Make the Road New York (MRNY) is a community organization that aids Latino and working class communities in New York City. Its campaigns take a combined approach to interrelated issues, including workers' rights, immigrant rights, LGBT rights, and housing issues.[35] In addition to engaging in community organizing, Make the Road also offers legal advocacy, policy advocacy, education, and youth programs.[36]

According to its website, MRNY has helped win $15 million in back wages for workers.[37]

WASH New York Campaign Organizes NYC Car Wash Workers

Since June 2012, MRNY has worked with New York Communities for Change and the Retail, Wholesale and Department Store Union to help organize workers at New York City car washes.[38] By September 2012, the campaign had resulted in workers at Astoria Car Wash and Hi-Tek 10 Minute Lube Inc. voting to form a union, the first time New York City car wash workers had done so.[39] As of July 2014, workers at six car washes had won collective bargaining contracts.[37]

MRNY has also helped car wash workers at a number of companies file lawsuits related to alleged labor violations.[39]

A series of inspections by the New York State Department of Labor in 2008 found that around 80% of car washes in New York City were "in violation of minimum wage and overtime laws," with an estimated $6.5 million in underpayments during a two week period.[40] New York City has about 200 car washes, most individually owned, employing approximately 5,000 people. Many workers are undocumented immigrants.[39]

In December 2013, WASH New York produced a report on environmental and consumer practices in the car wash industry, "Consumer Abuse and Environmental Hazards in New York City’s Car Wash Industry."[41]

Click here to read the report.

Committee for Better Banks Raises Concerns About Bank Employees

Along with other member organizations of the Committee for Better Banks, MRNY published a 2013 report on job conditions in the banking industry titled, "The Committee for Better Banks Report: The state of the bank employee on Wall Street." Based on academic research, interviews, and survey data, the report expressed "major concerns that this is the tale of two banking industries – one of high paid executives and the other of struggling regular workers."[42]

The report found that while "the top fifty financial CEOs’ compensation collectively rose by 26% in 2010 and by 20.4% in 2011," the financial industry in New York City has shed 19,800 jobs since 2008. It also found that nearly one third of bank tellers nationwide received some form of public assistance due to their low wages.[42] Data provided by the University of California-Berkeley's Labor Center estimate the annual cost to the public at almost $900 million, which the Washington Post noted "amounts to a public subsidy for multibillion-dollar banks."[43]

According to the report, the majority of workers surveyed in New York City reported high levels of stress due to layoffs and increasing sales pressure. Many workers "report working off the clock in order to make sales goals." 32% of workers report that they are not paid for overtime, "and many others explain that the bank does not allow them to even report overtime hours worked."[42]

Click here to read the report.

TakeAction Minnesota (Minnesota)

TakeAction Minnesota organizes individuals and groups in Minnesota to work for racial and economic justice. TakeAction has offices in Saint Paul, Duluth, and Grand Rapids, MN.[44]

TakeAction's major issue areas are work, criminal justice reform, health, democracy, voting rights, and elections. Activities in 2014 include a campaign to raise the minimum wage, fighting the Trans-Pacific Partnership and opposing off-shoring of call center jobs.[45]

Additional Local and State Organizations

- Arise (Chicago), http://arisechicago.org/

- DC Employment Justice Center, http://www.dcejc.org/

- FRESC (Colorado), http://fresc.org/

- Kentucky Equal Justice Center, http://www.kyequaljustice.org/

- MassCOSH (Massachusetts Coalition for Occupational Safety and Health), http://www.masscosh.org/

- New Mexico Center on Law and Policy, http://nmpovertylaw.org/

- Northwest Workers' Justice Project (Oregon), http://nwjp.org/

- Public Justice Center (Maryland), http://www.publicjustice.org/

- Working Hands Legal Clinic (Chicago), http://www.workinghandslegalclinic.org/

- Workers Defense Project/Projecto Defensa Laboral (Texas), http://www.workersdefense.org/

ALEC Bills Related to Wage Theft

| About ALEC |

|---|

ALEC is a corporate bill mill. It is not just a lobby or a front group; it is much more powerful than that. Through ALEC, corporations hand state legislators their wishlists to benefit their bottom line. Corporations fund almost all of ALEC's operations. They pay for a seat on ALEC task forces where corporate lobbyists and special interest reps vote with elected officials to approve “model” bills. Learn more at the Center for Media and Democracy's ALECexposed.org, and check out breaking news on our ExposedbyCMD.org site.

|

In 2013 alone, the American Legislative Exchange Council (ALEC) introduced 117 bills related to workers and worker rights, according to the Center for Media and Democracy. [46] In addition to anti-union "right to work" and "paycheck protection" bills, ALEC has bills that would directly suppress wages for workers.

- Resolution in Support of Reform of Wage and Hour Laws, which advocates for major changes to the Fair Labor Standards Act.

- Living Wage Mandate Preemption Act, which would allow a state to prevent its cities and counties from setting minimum wages that exceed those required under state or federal law.

- Prevailing Wage Repeal Act, which would repeal "prevailing wage" requirements for government contractors, lowering wage standards for public projects.

- Starting (Minimum) Wage Repeal Act, which would repeal the minimum wage.

News and Lawsuits

Many of these cases are described in NELP's 2013 report, "Winning Wage Justice: A Summary of Criminal Prosecutions of Wage Theft in the United States."

Car Washes

Santa Monica Car Wash Pleads No Contest to Wage Theft Charges, 2013

In 2012, a joint investigation by the California Labor commissioner and the U.S. Department of Labor found that Wilshire West Car Wash LLC had "altered employee time records, created false time records, and coerced employees into signing declarations that falsely stated that they had received paid breaks."[1] In 2013, the Santa Monica City Attorney followed up by filing an 11-count criminal complaint against the car wash and its parent company, Maxxam Enterprises III, charing the business owner, general manager, and two supervisors with "conspiracy to cheat employees out of their wages."[47] In November 2013, Wilshire West Care Wash "pled no contest to six misdemeanor charges including failure to record and pay for work breaks," and the two supervisors also entered plea agreements. Employees were to receive $656,547 in back pay as part of the agreement, and the car wash paid about $8,000 in fines and penalties.[48]

Long Island NY Car Wash Guilty of Failing to Pay Minimum Wage, 2013

A car wash in Long Island, New York was found to have paid hourly workers as little as $4 an hour after an investigation by the New York Attorney General. The car wash's owner pled guilty to a charge of "Failure to Pay Wages in Accordance with the Labor Law," agreed to pay $75,000 in restitution to the workers, and was to complete 40 hours of community service. The business submitted to two years of monitoring by the Attorney General's office.[1][49]

Construction, Day Labor, and Landscaping

Construction Firms in New York City Get Millions in Tax Breaks Despite Allegations of Wage Theft

Workers at New York City construction sites run by Galaxy Construction and L+M Development Partners were allegedly paid less than the required prevailing wage and sometimes less than minimum wage, while the two companies have received millions of dollars in tax breaks through the city's 421-a program, according to New York Daily News.[50] The tax abatement program, which is meant to encourage housing construction, costs the city more than $1 billion per year.[51]

Galaxy and several subcontractors agreed to pay $753,000 to settle a lawsuit in 2013, in which security guards alleged that they had been paid only $600 for 100-hour workweeks, significantly below minimum wage. Galaxy was put on the city's "enhanced review" list and closely monitored by the city; at that time, it reportedly owed $1.4 million in back wages.[50] In November 2013, a U.S. Department of Labor official accused a Galaxy subcontractor of an additional $2.9 million in wage theft,[50] which Larino agreed to pay.[52] Despite these wage problems, Galaxy has saved $2.39 million in taxes through the tax break just on a single building in Queens. Galaxy did not comment on the wage theft allegations to the Daily News.[50]

L+M Development Partners has frequently subcontracted to MC&O Masonry, which according to the Daily News "has in turn been cited several times for ripping off workers." One MC&O worker reported by instructed to tell city inspectors he was being paid $30-35 per hour, despite actually being paid only $12. L+M Development has saved $5,265,465 in taxes on three buildings, the Daily News calculated.[50]

A third developer, Lemle & Wolff, saved $14,720,952 in taxes between 2007 and 2014 on one building, while also being listed on the "enhanced review" list for reportedly owing $500,000 in back wages.[50]

Study Finds "Epidemic" of Misclassification and Wage Theft in MA Construction, 2015

Residential construction contractors in Massachusetts responded to the post-2008 recession "by wholesale and illegal misclassification of their workers as independent contractors," saving 30 percent on building costs by avoiding paying workers' comp and taxes on workers' wages, according to a 2015 study by sociologists at the University of Massachusetts-Amherst. The study also found that contractors frequently "pay late, do not compensate for overtime, and sometimes do not pay for work at all," and that enforcement mechanisms do not work effectively in an industry now dominated by "marginal subcontractors" that "reorganize and start new firms to avoid prosecution and to continue illegal misclassification and wage theft."[53]

See the full report, "The Epidemic of Wage Theft in Residential Construction in Massachusetts," here.

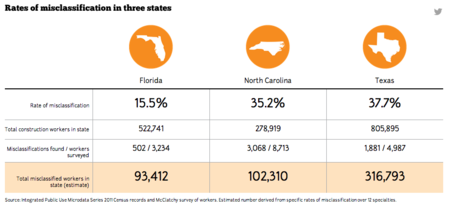

Rampant Misclassification on Federal Stimulus Projects, 2009-2014

A year-long investigation by journalists in seven states working for McClatchy newspapers uncovered what they described as "widespread cheating by construction companies that listed workers as contractors instead of employees in order to beat competitors and cut costs." Misclassifying workers as independent contractors allows the companies to avoid paying payroll and unemployments taxes and to avoid providing workers' compensation. The reporting suggests that government officials tasked with enforcement frequently let the misclassification slide on projects that were paid for with federal stimulus funds. "McClatchy’s analysis of payroll records for government-backed housing projects shows the federal government losing billions in tax revenue each year from the construction industry alone."[54]

As the investigation notes, how workers are classified for tax and insurance purposes is not simply a business decision. The U.S. Department of Labor and the Internal Revenue Service have specific rules regarding which kinds of workers can be classified as independent contractors. "The tests center on control, both financial and behavioral. Does the boss dictate when and how the worker gets the job done? Is the compensation enough to allow the worker to operate as if he’s self-employed with overhead of his own?"[55]

The reporters found that Labor Department officials found substantial problems in the investigations they did conduct: "In 2010, a team of 33 experienced investigators picked 51 stimulus projects to inspect for wage violations. Over the ensuing four years, the agency collected more than $10 million in back pay owed to 6,500 workers cheated on wages for those projects," and found wage and hour violations in 62 percent of the 1,278 investigations conducted between 2010 and 2013."[54] The McClatchy investigation found rampant violations by analyzing payroll records. For example, in North Carolina alone, "more than a third of 8,713 workers hired by private companies to build government-backed housing since 2009 were treated as independent contractors, rather than employees as the law and regulations require." As a result, the state and federal governments miss an estimated $470 million in unpaid income and payroll taxes each year.[56]

See the full investigation, "Misclassified: Contract to Cheat," here.

San Francisco Painting Contractor Charged with Wage Theft and Insurance Fraud, 2012

In January 2012, the San Francisco Attorney General charged Frances Doherty of Doherty Painting & Construction with "57 felony counts related to wage theft, filing false instruments, offering fraudulent documents, and workers’ compensation insurance premium fraud." While the company had reported paying employees the prevailing wage for workers on public agency contracts, the Attorney General's office "alleged that Doherty Painting’s employees were only paid a fraction of the wages to which they were entitled. It is also alleged that Doherty provided fraudulent information to public agencies that were doing compliance audits in an effort to conceal the prevailing wage violations."[57]

As of July 2014, no information could be found about the outcome of the case.

CA Concrete Company Charged with Evading Payroll Taxes, Workers' Comp Fraud, 2010

In November 2010, the California Attorney General's office charged T. B. Concrete, Inc. with "15 felony counts of payroll tax evasion and workers’ compensation insurance fraud." According the the Attorney General, an investigation started in 2008 found that CEO Thomas Bernhardt and office manager Rachel Bernhardt "intentionally under-reported wages by disguising the funds as payments made to independent contractors in order to illegally reduce the company’s state payroll tax and workers’ compensation expenses." The investigation found that T. B. Concrete underreported wages by $2.1 million between 2004 and 2009.[58]

As of July 2014, no information could be found about the outcome of the case.

Hospitality Industry

Investigation Finds "Rampant" Violations in North Texas Hotel Industry, 2015

A Labor Department investigation "uncovered the rampant practice of employees being forced to work off the clock and often for less than minimum wage in the North Texas hotel industry," the Fort Worth Star-Telegram reported in March 2015. 639 hotel workers including housekeepers, cooks, and maintenance workers received more than $180,000 in back pay as a result of the investigation, which focused on third-party staffing agencies. S&A Staffing was reportedly the largest violator, according to the Star-Telegram.

- “We are taking a hard look at the hotel industry where employment practices, such as subcontracting, franchising and third-party management, can put downward pressure on costs — often at the expense of wages,” Cynthia Watson, regional administrator for the agency’s Wage and Hour Division in the Southwest, said in a statement.[59]

Workers Stage Campaign Against Darden Restaurants, 2012-2014

In 2012, workers at restaurants owned by the Darden Group, including Red Lobster, Olive Garden, and Capital Grille, began a campaign of protests and lawsuits against Darden. The campaign is supported by ROC United.[60] Litigation includes wage theft and discrimination complaints in New York City, Los Angeles, and Chicago (with additional complaints planned in Miami and Maryland), as well as Equal Employment Opportunity Commission complaints filed in Miami, NYC, Chicago, and Maryland.[61] As initially filed in 2012, the lawsuit against Capital Grille alleged that "Capital Grille forced employees to work without pay, did not provide rest breaks to workers and forced tipped employees to share their tips with non-tipped workers," according to Reuters. At that time, Darden spokeperson Rich Jeffers said, "Darden Restaurants is very proud of the work environment that it creates for employees."[62]

As of July 2014, this litigation had not yet been resolved.[63]

ROC United published a report on Darden in 2012, titled "Darden’s Decision: Which Future for Olive Garden, Red Lobster, & Capital Grille." Click here to read the report.

McDonald's Workers in Three States File Lawsuits Alleging Wage Theft, 2014

In March 2014, McDonald's workers in New York, California, and Michigan filed a total of seven lawsuits "against the company and several franchise owners, asserting that they illegally underpaid employees by erasing hours from their timecards, not paying overtime and ordering them to work off the clock," according to the New York Times. The Michigan lawsuits also argued that the company's "requirement that employees pay for their uniforms illegally reduced their pay below the federal minimum wage of $7.25 an hour."[64]

McDonald's released a statement in response, saying in part, "McDonald's and our independent franchisees are committed to undertaking a comprehensive investigation of the allegations and will take any necessary actions as they apply to our respective organizations."[65]

The New York Times reported that the plaintiffs' lawyers argue that the McDonald's corporation should be considered jointly liable for violations at McDonald's franchises. The company, "like many other fast-food chains with franchises, has argued in the past that it is not a joint employer and should not be liable for its franchisees’ misdeeds on the ground that the franchised restaurants are independently run businesses."[64]

On July 28, 2014 the general counsel of the National Labor Relations Board (NLRB) authorized complaints in 43 cases against McDonald's and ruled that McDonald's is a joint employer,[66] meaning that it "could be held jointly liable for labor and wage violations by its franchise operators," according to the New York Times.[67] In response, "McDonald's said that its assistance to its more than 3,000 franchisees doesn't establish a joint employer relationship as described by the NLRB" and "vowed to fight the decision," according to the Washington Post.[68]

As of July 2014, the suits had not been resolved.

Subway Franchisee Allegedly Created Fake Workers to Avoid Paying Overtime, 2014

A former worker at a Subway sandwich franchise filed a lawsuit in August 2014 alleging that his employer underpaid him for two years, in part by paying him under multiple names as if the work had been done by multiple employees. The worker, Erwin Zambrano Moya, claimed that he often worked 70 hours per week, but was not paid for overtime. The complaint states, "To hide Plaintiff's very high number of hours worked per week, Defendant regularly paid Plaintiff about half of his wages under his name and about half under a fictional employee name, typically, Ever Ventura." Moya also claims that he was paid less than the prevailing minimum wage in Washington, D.C., where the restaurant was located.[69]

As of August 2014, the lawsuit had not been resolved.

Lawsuit Filed Against McDonald's over High-Fee Payroll Debit Cards

Payroll cards have become increasingly common in low-wage industries in recent years, including at companies like Wal-Mart and McDonald's, sparking complaints about their relatively high cost to users, who are often charged fees for ATM use, balance statements, or even inactivity. The New York Times has noted that "For banks that are looking to recoup billions of dollars in lost income from a spate of recent limits on debit and credit card fees, issuing payroll cards can be lucrative — the products were largely untouched by recent financial regulations."[70] In June 2013, a class action lawsuit filed against McDonald's over the cards alleged that employees were pushed to take their pay via the high-fee cards.[71] The case had a hearing in March 2014,[72] and in July JP Morgan Chase & Co. and JP Morgan Chase Bank were added to the suit as defendants.[73] As of August 2014, the suit had not been resolved.

Indianapolis Hotel Workers Reach Settlement with Hospitality Staffing Solutions, 2012

In January 2012, sixteen workers at hotels in Indianapolis filed a lawsuit against their employer, Hospitality Staffing Solutions, alleging that "they were forced to work off the clock and through their unpaid breaks, sometimes pushing their earnings below the minimum wage of $7.25 per hour," and that hotel management was aware of the situation.[74] Labor at hotels increasingly has been outsourced to firms like Hospitality Staffing Solutions, which often classify their workers as temps, require greater workloads, pay lower wages, and offer few or no benefits.[75] The suit was settled in December 2012 for an undisclosed amount, with some workers telling Huffington Post that conditions have improved as a result of the suit. In a statement, Hospitality Staffing Solutions said that "While these employees’ claims could not be verified, the Company has resolved their claims in good faith and in order to avoid the expense and distraction of litigation."[76]

Queens Restaurant Guilty of Failing to Pay Minimum Wage, Retaliation, 2012

A New York State Department of Labor investigation of a restaurant in Queens, New York "revealed that for over 3 years, the defendants paid waiters daily rates of just $25-40 per day, regardless of how many hours they worked. Waiters often had to work more than 12 hours per day, resulting in hourly rates of only $2 per hour, or even lower. In addition, managers unlawfully kept a portion of the waiters' tips," according to the NELP.[1] The New York Attorney General reported that in addition to wage theft, the restaurant retaliated against employees who filed complaints and filed a false state quarterly tax return "to avoid paying unemployment insurance taxes." As part of his guilty plea, owner Charles Cha agreed to "pay $450,000 in unpaid wages, interest and penalties, and another $27,959.88 in Unemployment Insurance taxes and related interest and penalties."[77] The defendants also agreed to submit to monitoring by the Attorney General's office for three years.

Personal Care and Service

NY Times Investigation Finds Rampant Wage Theft, Ethnic Discrimination in Nail Salons

The "vast majority" of workers in New York City nail salons were paid less than the minimum wage, and some were not paid at all, a 2015 investigation by The New York Times found.

- "Among the more than 100 workers interviewed by The Times, only about a quarter said they were paid an amount that was the equivalent of New York State’s minimum hourly wage. All but three workers, however, had wages withheld in other ways that would be considered illegal, such as never getting overtime."[78]

The report described newspaper ads advertising pay rates as low as $10 per day. Salon workers, most of whom are immigrants and many of whom were undocumented, reported paying "training fees" of $100 or more to begin working and receiving no pay for the first several weeks or months of work. The investigation also found a "stark ethnic hierarchy imposed by nail salon owners":

- "Korean workers routinely earn twice as much as their peers, valued above others by the Korean owners who dominate the industry and who are often shockingly plain-spoken in their disparagement of workers of other backgrounds. Chinese workers occupy the next rung in the hierarchy; Hispanics and other non-Asians are at the bottom."[78]

Nail salon workers may also be exposed to high concentrations of many chemicals linked to respiratory problems, cancer, miscarriages, and other health problems, including formaldehyde, toluene, and dibutyl phthalate, according to The New York Times. Industry groups including the Personal Care Products Council have opposed banning or further regulation such chemicals. The Personal Care Product Council finances the Cosmetic Ingredient Review, which claims to "review and assess the safety of ingredients used in cosmetics in an open, unbiased and expert manner." [79]

Four days after the investigation was published, New York Governor Andrew Cuomo "ordered emergency measures" to address the wage theft and health issues. Cuomo announced the creation of "a new, multiagency task force will conduct salon-by-salon investigations, institute new rules that salons must follow to protect manicurists from the potentially dangerous chemicals found in nail products, and begin a six-language education campaign to inform them of their rights." The new rules included requiring workers to use protective gloves and masks and for salons to be well-ventilated. The plan also called for salons to be bonded, a requirement intended to make it easier for workers to be paid if owners found guilty of wage theft attempt to hide their assets.[80]

Manicurists and pedicurists are fast-growing occupations, according to the Bureau of Labor Statistics. BLS data reports approximately 86,900 people worked as manicurists and pedicurists in 2012.[81] New York City had approximately 17,000 nail salons in 2015.[78]

IT Industry/Silicon Valley

"Task Sharing" Startup Sued for Misclassifying Workers, Violating Minimum Wage, 2014

The company Handy, a startup that connected "freelance" workers to people looking for house cleaners and other home maintenance services, was sued in November 2014 for allegedly misclassifying its workers as independent contractors and driving their compensation below minimum wage. This form of misclassification is a common tactic for employers seeking to avoid paying overtime, benefits, worker's comp, and other labor expenses.[54] As reported by ValleyWag, which covers tech news and obtained a copy of the suit,

- "The lawsuit, filed in a California court by two former Handy house cleaners, says the startup is deliberately misclassifying employees as independent contractors. It's alleged the company exerts significant control over workers, which the complaint claims is sufficient proof that Handy's contractors should be classified as employees."[82]

The suit claims that Handy gives workers specific instructions for how to dress, how to interact with customers, whether they can hire additional help, and even how to use the bathroom at work sites. As of November 2014, the suit had just been filed and no decision had yet been made.[83]

Supreme Court Hears Amazon Warehouse Worker Suit, 2014

In 2010, two workers who had been employed by Integrity Staffing Solutions to work at Amazon warehouses filed a class action suit, claiming that workers were owed pay for time spent in security lines before leaving the warehouse each day. After clocking out after a shift, workers were required to go through security screenings, which took an average of 25 minutes each day. Nevada's The Morning Call reported in 2013 that their attorneys "estimate some 100,000 people are owed more than $100 million in back wages and penalties for time spent on security lines."[84]

In March 2014, the U.S. Supreme Court agreed to hear the case, Integrity Staffing Solutions v. Busk. In These Times reported that the suit has drawn interest from "pro-business lobby groups, which often fight interpretations of the FLSA that would lead to an expansion of overtime pay. The Retail Litigation Center, the Society for Human Resources Management, the U.S. Chamber of Commerce and the National Association of Manufacturers filed a joint amicus brief in the case in favor of denying additional wage payments to the workers."[85]

In December, the Court announced its decision that the agency was not required to pay workers for security screening time. As described by The New York Times, the case hinged on interpretation of the 1947 "Portal to Portal Act." The Ninth Circuit Court of Appeals had previously "allowed the case to proceed, saying the screenings were for the company’s benefit and were a necessary part of the workers’ jobs. That was enough, the appeals court said, to make the screenings "integral and indispensable.'" But Justice Clarence Thomas, writing for the Supreme Court's unanimous decision, "said the screenings were not “integral and indispensable” to the workers’ jobs, which involved retrieving products from warehouse shelves and packaging them for delivery to Amazon’s customers. That meant, he said, that no extra pay was required."[86]

Many workers at warehouses are temps hired through staffing agencies and contractors.[87] Investigative reporters have published multiple exposes about working conditions in Amazon warehouses, including "Inside Amazon's Warehouse" by The Morning Call and "I Was a Warehouse Wage Slave" by Mother Jones.

$324M Settlement in Silicon Valley Hiring Collusion Case, 2013

In 2010, the U.S. Department of Justice (DOJ) filed an antitrust complaint against six tech companies -- Adobe, Apple, Google, Intel, Intuit, and Pixar -- alleging that "the six companies entered into agreements that restrained competition between them for highly skilled employees."[88]

A lawsuit based on the DOJ complaint was filed against Google, Apple, Intel, and Adobe was certified as a class action in 2013. 64,613 software engineers accused the tech giants "of agreeing not to solicit one another’s employees in a scheme developed and enforced by Steven P. Jobs of Apple. In their drive for control, the companies undermined their employees’ opportunities to get better jobs and make more money, the court papers say," the New York Times reported.[89] According to the New York Times, the plaintiffs claimed lost wages totalling $3 billion as a result of alleged hiring collusion between 2005 and 2009.[3]

The lawsuit was settled for $324 million in April 2014, a few weeks before the trial was to begin.[4]

Retail

Immigrant Grocery Workers Win $305,000 Settlement for Wage Theft, 2015

Employees working for a grocery store in Aurora, Colorado won $305,000 in back wages and penalties when a U.S. District Court approved a settlement in July 2015. The settlement was to be shared with around 40 workers who were involved in the suit. The workers were represented by Towards Justice, whose executive director said the case brought attention to immigrants and undocumented workers as a particularly vulnerable population.[90]

Janitors Contracted to Clean Macy's, Herberger's File Suit Alleging Wage Theft, 2015

Workers hired by the cleaning contractor Capital Building Services Group to clean Macy's and Herberger's stores in the Twin Cities area filed a class action lawsuit against Capital in May 2015. The suit claims that the subcontractor paid workers less than minimum wage and did not pay overtime. As reported by People's World:

- Leyla Yusuf, a former Capital employee, said the company did not provide paycheck stubs with information on wages, hours and overtime to its employees. When she suspected she was not being paid in full, she demanded to see a pay stub.

- "The reason I got fired is because I asked for my check stub," Yusuf said through a translator. "I spoke up, and I'll never be silenced. We are here to get it right."[91]

According to Minneapolis City Pages', the workers' claims include:

- They claim Capital ignores travel time to and from stores and deducts meal breaks from timesheets even when employees skip meals.

- They say some janitors have to buy their own cleaning supplies, which causes their overall pay to dip below minimum wage. The lawsuit also alleges that Capital doesn't always give employees paystubs, a labor law violation that makes it hard for workers to prove how much they worked and what they're owed.[92]

An attorney for Capital "said the firm is committed to treating all workers fairly and will fight the allegations in court," according to Minnesota Public Radio.[93]

Walmart Ordered to Pay $188 Million in Wage Theft Lawsuit, 2014-2015

In December 2014 the Pennsylvania Supreme Court confirmed earlier court decisions from 2006, 2007 and 2011 that require Walmart to pay $151 million in lost wages and damages and $36 million in attorney fees for underpaying wages to Walmart and Sam’s Club employees in Pennsylvania from 1998-2006.[94] The court confirmed that Walmart forced employees to miss or shorten paid rest breaks and to work “off the clock” after punching out. The ruling is expected to affect approximately 187,000 employees and former employees.

A Walmart spokesperson told Reuters, "Walmart has had strong policies in place to make sure all associates receive their appropriate pay and break periods."[94] Despite having lost at every appeal, the company has again appealed the decision, this time to the U.S. Supreme Court, arguing that the workers' claims should not have been grouped into a class action suit.[95]

Wal-Mart Settles Another Wage Violation Complaint, 2012

In 2012, the U.S. Department of Labor Wage and Hour Division (WHD) found that Wal-Mart had "failed to pay overtime to more than 4,500 workers," as reported by the Wall Street Journal.[96] According to the WHD, Wal-Mart had improperly classified some vision center managers and asset protection coordinators as exempt from overtime. In the settlement, Wal-Mart agreed to pay $4,828,442 in back wages to over 4,500 workers and former workers, and an additional $463,815 in civil penalties.[97] A spokesperson for Wal-Mart told the Wall Street Journal that the retailer took the issue seriously and "fully cooperated with the Department of Labor" in correcting the violations.[96]

Staples Settles Lawsuit Over Misclassifying Employees, 2010

In February 2010, the big box office supply store Staples agreed to settle a class action lawsuit "related to allegations that the company had not paid its assistant store managers overtime to which they were entitled," according to the Boston Globe.[98] The lawsuit claimed that assistant managers had been improperly classified as employees exempt from overtime pay.[99] Staples agreed to pay $42 million to settle the suit, but did not admit any wrongdoing.[98]

Wal-Mart Settles 63 Wage Violation Lawsuits, 2008

In December 2008, retail giant Wal-Mart agreed to settle 63 lawsuits in 42 states related to claims "that it forced employees to work off the clock," as the New York Times reported. The wage-and-hour suits alleged violations including "forcing employees to work unpaid off the clock, erasing hours from time cards and preventing workers from taking lunch and other breaks that were promised by the company or guaranteed by state laws." Wal-Mart agreed to pay at least $352 million to settle the claims.

According to the Times, the company's critics "saw the settlement as proof of their view that the company achieves its low prices in part by cheating workers," while Wal-Mart attributed violations to local managers. Wal-Mart's general counsel, Tom Mars, said in 2008 that "the allegations are not representative of the company we are today."[100]

Transportation

Minnesota Trucking Company Guilty of Felony Theft, 2012

Owner Gary Bauerly of Minnesota's WATAB Hauling Co. was charged with not paying workers the government-required wage for road workers and pled guilty to "felony theft by swindle." According to the Hennepin County Attorney General's office, "Bauerly admitted that he, or someone under his control, submitted false certifications that they were paying the prevailing wage when WATAB was not. According to the criminal complaint (PDF), Bauerly kept the difference between what he was supposed to pay and what he actually did pay the drivers," netting over $52,000 in 2007.[101] In February 2013, Bauerly was sentenced to pay $52,157 in restitution to workers.[102]

Policy Responses to Wage Theft

Wage Liens Help Workers Recover Lost Wages

Chart from the National Employment Law Project

Wage lien laws provide a tool to help workers recover unpaid wages they are owed. A wage lien "allows workers to place a temporary 'hold' on the property of an employer until the employer pays the workers they wages they have earned," as described in a report by the National Employment Law Project (NELP).[103]

Such laws make it more likely that workers will be able to recover the wages they are owed and can encourage resolution of wage theft cases without the expense of a court case.[104] Supporters of wage liens argue that they "are needed because many workers who win claims for back pay [...] often can't collect their awards," as the LA Times reported.[105]

According to the Center for Popular Democracy,

- "When workers do file a complaint, employers often hide or sell their assets to avoid paying or simply ignore a judgment requiring them to pay the worker. Under the new law, the lien will keep the employer from selling, hiding or disposing of their property until the wages are paid, encouraging them to pay up quickly."[104]

Typically, the laws do allow employers to dispute liens and address the potential for frivolous or bad faith claims. Court costs may be assigned to the losing party,[106] which discourages frivolous lawsuits and encourages employers to pay unpaid wages they owe, rather than incur the expense of losing the case in court.[107]

The NELP notes that wage lien laws are "modeled on the mechanic’s lien, which covers work performed or materials furnished in construction or land improvements—and which all states, including California, have enacted."[103]

The Public Justice Center published an FAQ about wage lien bills in February 2013.

States statutes allowing liens for unpaid wages include:

- Alaska

- Idaho (passed, 1999)

- Maryland (passed, 2013)

- New Hampshire

- Texas (passed, 1993)

- Vermont (passed, 2012)

- Washington (proposed, 2014)

- Wisconsin

- California (proposed, 2014)

Tools for Fighting Worker Misclassification

Misclassification--when a business incorrectly claims that workers are "independent contractors"--is a growing problem. As NELP points out, misclassification is popular among some business owners because it "decreases employers’ payroll costs by 15 to 30%. It also lets employers off the hook for rules protecting “employees,” including the responsibility to pay minimum wage and overtime, provide workers’ compensation, and to bargain with unions."[108] The New York Times reported in 2010 that "One federal study concluded that employers illegally passed off 3.4 million regular workers as contractors, while the Labor Department estimates that up to 30 percent of companies misclassify employees."[109] Some business lobbies such as the U.S. Chamber of Commerce have tried to paint enforcement as merely a grab for revenue or a form of harassment. For example, Chamber of Commerce representative Randel K. Johnson told The New York Times, "The goal of raising money is not a proper rationale for reclassifying who falls on what side of the line [...] The laws are unclear in this area, and legitimate clarification is one thing. But if it’s just a way to justify enforcing very unclear laws against employers who can have a legitimate disagreement with the Labor Department or I.R.S., then we’re concerned." However, in addition to reducing tax revenue for state and federal governments, misclassification causes problems for workers, who lose minimum wage and overtime protections, workers' compensation, unemployment insurance, and other protections, and makes it hard for law-abiding businesses to compete with firms that reduce labor costs by breaking the law.

IRS guidelines for determining whether someone is an independent contractor or employee are available here.

Some tools for fighting worker misclassification include:

- IRS investigation, through IRS Form SS-8

- Filing claims with administrative agencies, such as state or federal departments of labor or the National Labor Relations Board

- Legislation or policy changes

A number of states have enacted changes to help prevent worker misclassification, including task forces with investigation and enforcement powers and by establishing a presumption that workers are employees and requiring businesses to prove that independent contractors are correctly classified. An investigation by reporters for McClatchy and Pro Publica found significantly less misclassification of construction workers in New York and Illinois, which have addressed misclassification more aggressively, than in other states without such protections.[110]

- Illinois 820 ILCS 185 "Employee Classification Act". Illinois also created a task force in 2012 that includes "the state attorney general, the Workers' Compensation Commission and the state Departments of Labor, Revenue and Employment Security. All share information about suspected violators and work together to ensure guilty parties pay up." In 2013 the task force identified more than 9,000 workers who had been misclassified and collected $2.3 million in taxes that had not been reported.[110]

- Minnesota Statute 181.723 (passed, 2007)

- New York created a Joint Enforcement Task Force in 2007 that investigates cases and conducts random sweeps of worksites, finding some 114,000 cases between 2007 and 2014 adding up to $1.8 billion in lost wages.[110]

- Nebraska LB 563, "Employee Classification Act" (passed, 2010)

- Washington HB 3122 (passed, 2008)

Shortened Investigations Help New York Recoup $30 Million for Workers in 2014

Policy changes helped New York's Division of Labor Standards reduce its backlog of cases and complete 80 percent of its investigations within six months, a 2015 audit found. The changes resulted in a 35 percent increase in the amount of wages recovered in 2014 compared to the previous year, totaling more than $30 million recovered for around 27,000 workers, according to the Associated Press.[111]

List of State and Local Legislation Related to Wage Theft

Connecticut SB 914, 2015

Connecticut SB 914 was signed into law in June 2015. The law "that will allow victims of wage theft to collect double the amount due them," and shifts the burden of proof from the employee to the employer, In These Times reported.[112]

California SB 588, 2015 (proposed)

A bill that "would target the employer’s property as a way to discourage employers from walking away from payroll obligations by shutting down the company" was proposed by California state Senate leader Kevin de León in April 2015 and passed by the state Senate in June 2015.[113] SB 588 would require that businesses with judgements related to unpaid wages purchase a "wage bond" of $150,000, or California's Labor Commissioner would be able to file a lien on the employer's property, according to the Sacramento Business Journal.[114]

Colorado Wage Protection Act, 2014

In 2014, Colorado passed SB 5, the "Wage Protection Act."[115] A statement by the Colorado Senate Democrats stated that the Act "helps the Colo. Dept. of Labor and Employment to enforce wage theft by adding staff, establishing an administrative process to handle claims, and requiring the department to investigate claims of up to $7,500 per employee."[116]

Oregon HB 2977B, 2013

In July 2013, Oregon passed House Bill 2977, which addressed wage theft in the construction industry by requiring construction labor contractors to be licensed by the Oregon Bureau of Labor and Industries.[117] The legislation addressed cases in which a third-party labor broker hired construction workers, then failed to pay them.[118] The bill was modeled on a 1959 farm labor contractor law.[119]

Maryland Lien for Unpaid Wages, 2013

In May 2013, Maryland passed the Lien for Unpaid Wages Act, which went into effect October 1, 2013.[120] The act "provides workers the option of “freezing” the employer’s assets before filing a court action," an option that "will keep the employer from selling, hiding or disposing of their property until the wages are paid, encouraging them to pay up quickly," according to the Center for Popular Democracy, a supporter of the bill.[121]

New York Wage Theft Prevention Act, 2011; Task Force to Combat Worker Exploitation, 2015

New York's Wage Theft Prevention Act, which went into effect in April 2011, specifies requirements for notifying employees about their pay rate.

New York Gov. Andrew Cuomo announced in July 2015 that he was forming a Task Force to Combat Worker Exploitation, a "statewide, multiagency task force dedicated to investigating worker exploitation and abuse across a variety of industries, including restaurants, child care services and carwashes," according to The New York Times.[122]

See here for information about the task force and links to translations into other languages.

Task force hotline to report worker exploitation and wage and workplace violations in New York state: 1-888-469-7365

California Wage Theft Protection Act, 2011

California's Wage Theft Protection Act, which went into effect January 1, 2012, requires all employers to provide employees with a written notice of basic employment information, including the pay rate and contact information for the employer.[123] The notice must also be "in the language the employer normally uses to communicate employment-related information to the employee."[124]

Illinois Wage Payment and Collection Act, 2011

In July 2010, Illinois passed a set of amendments to its Wage Payment and Collection Act, effective January 2011. The amendments included adding a fine and interest to back wage payments, adding a new administrative procedure to make smaller cases easier to pursue, and made repeat offenses a felony charge.[125]

The legislation was pushed by the Just Pay for All Campaign, whose participants included Centro de Trabajadores Unidos and Interfaith Worker Justice.[126]

New Mexico HB 489, 2009

In 2009, New Mexico passed HB 489, which included anti-wage theft provisions like extending the statute of limitations for wage theft claims, tripling the amount owed by employers found in violation of wage laws, and adding protections for workers against retaliation.[127][128] The act made New Mexico one of the first states to pass wage theft legislation.[129]

Wage Theft Prevention Act, Washington, D.C., 2014

The D.C. Wage Theft Prevention Act of 2013 includes provisions that broaden the definition of "wages," provide for quadruple damages for employees recovering unpaid wages, and expand the authority of the D.C. Department of Employment Services to pursue damages.[130] In May 2014, the D.C. City Council sought to amend the Act, adding higher penalties, creating a formal hearing process, requiring employers to provide written notice about the terms of employment to their workers, and creating "joint and several liability between contractors and subcontractors."[131]

Anti-Wage Theft Ordinance, Chicago, IL, 2013

In January 2013, the City of Chicago passed an ordinance allowing the city to revoke the business license of any business owner found guilty of wage theft.[132] Arise Chicago played a role in creating the ordinance, which was also endorsed by NELP.[133]

Wage Theft Prevention Act, New York City, NY, 2010

Organizing headed by Make the Road New York led to the passage in 2010 of the Wage Theft Prevention Act in New York City. The Act gave New York one of the strongest anti-wage theft laws in the U.S., according to The Nation, "more than doubling the fines, quadrupling penalties if employers threatened their workers with retaliation, and adding important new organizing tools (such as mandating that all paychecks include information on what the worker is being paid, based on how many hours, in the person’s native language)."[35]

Wage Theft Ordinance, Miami-Dade County, FL, 2010

In March 2010, Miami-Dade County in Florida became the first county in the U.S. to enact a wage theft ordinance.[134] The act, which applies to all employees of private employers who are working within Miami-Dade, regardless of where the employer is based, entitles an employees to back wages and damages if their employer is "found to have unlawfully failed to pay wages."[135] By 2012, the ordinance had helped workers win back almost $400,000 in wages owed, according to the Research Institute on Social and Economic Policy.[136]

Florida's Broward and Alachua counties have passed similar ordinances.[137][138] By 2014, over 30% of Florida residents lived in counties with local wage recovery laws.[139]

Reports and Additional Resources

National

- Good Jobs Nation, 2015: The Return of Federal Sweatshops? How America's Broken Contract Wage Laws Fail Workers

- McClatchy newspapers and Pro Publica, 2014: "Misclassified: Contract to Cheat"

- NELP, 2013: "Winning Wage Justice: A Summary of Criminal Prosecutions of Wage Theft in the United States."

- Economic Policy Institute, 2013: "The Legislative Attack on American Wages and Labor Standards, 2011–2012"

- U.S. Senate Health, Education, Labor, and Pensions Committee, 2013: "Acting Responsibly? Federal Contractors Frequently Put Workers’ Lives and Livelihoods at Risk"

- Progressive States Network, 2013: "Where Theft is Legal: Mapping Wage Theft Laws in the 50 States"

- Progressive States Network, 2012: "Cracking Down on Wage Theft: State Strategies for Protecting Workers and Recovering Revenues"

- NELP, 2011: "Winning Wage Justice: An Advocate’s Guide to State and City Policies to Fight Wage Theft"

- Columbia Law School, 2011: "Enforcement of State Wage and Hour Laws: A Survey of State Regulators"

- NELP, 2010: "Just Pay: Improving Wage and Hour Enforcement at the United States Department of Labor"

- Policy Matters Ohio, 2010: "Investigating Wage Theft: A Survey of the States"

- Excluded Workers Congress, 2010: "Unity for Dignity: Expanding the Right to Organize to Win Human Rights at Work"

- NELP, UCLA Institute for Research on Labor and Employment, and UIC Center for Urban Economic Development, 2009: "Broken Laws, Unprotected Workers: Violations of Employment and Labor Laws in America’s Cities"

- IWJ, 2008: Wage Theft in America: Why Millions of Americans are Not Getting Paid and What You Can Do About It

Resources on Temp Labor

- "Manufacturing Low Pay: Declining Wages in the Jobs That Built America’s Middle Class," National Employment Law Project, November 2014

- "Temp Land: Working in the New Economy," Pro Publica series (2013-2014)

- “Permanently Temporary: The Truth About Temp Labor,” Vice documentary series

- "Feds to Look Harder at Cell Carriers When Tower Climbers Die," Frontline report

- Center for Public Integrity News and Investigations on Temp Work

- Economic Hardship Reporting Project News on Temp Work

- "Who's the Boss: Restoring Accountability for Labor Standards in Outsourced Work," report by the National Employment Law Project (2014)

- "At the Company’s Mercy: Protecting Contingent Workers from Unsafe Working Conditions," report by the Center for Progressive Reform (2013)

- "The Rise of the Permanent Temp Economy," New York Times report (2013)

- "The Challenge of Temporary Work in Twenty-First Century Labor Markets," University of Massachusetts-Amherst Labor Relations and Research Center, working paper (2011)

- "Confronting Contingent Work Abuse in High-Tech and Low-Tech Jobs," Regional Labor Review article (2002)

Reporting on Silicon Valley Labor Issues

- New York Magazine, "Silicon Valley's Contract Worker Problem"

- Wired, "The Laborers Who Keep D*** Pics and and Beheadings Out of Your Facebook Feed"

- Mother Jones, I Was a Warehouse Wage Slave"

States

California

Florida

- Research Institute on Social and Economic Policy, 2012: "Wage Theft: How Millions of Dollars are Stolen from Florida’s Workforce"

Iowa

- Iowa Policy Project, 2012: "Wage Theft in Iowa"

Massachusetts

- University of Massachusetts-Amherst Labor Center, 2015: The Epidemic of Wage Theft in Residential Construction in Massachusetts

New Jersey

- Seton Hall School of Law, Center for Social Justice, 2011: "All Work and No Pay: Day Laborers, Wage Theft, and Workplace Justice in New Jersey"

- Seton Hall Law Project, 2010: Ironbound Underground: Wage Theft & Workplace Violations Among Day Laborers in Newark’s East Ward"

New York

- WASH New York (MRNY), 2013: "Consumer Abuse and Environmental Hazards in New York City’s Car Wash Industry"

- Committee for Better Banks (MRNY), 2013: "The State of the Bank Employee on Wall Street"

North Carolina

- North Carolina Justice Center, 2013: "Wage Theft in North Carolina: The Hidden Crime Wave Robbing Workers and Communities"

- North Carolina Justice Center, 2012: "It doesn't add up" - Ten North Carolina Workers Share Experiences of Wage Theft

Pennsylvania

- Sheller Center for Social Justice at Temple University Beasley School of Law, 2015: Shortchanged: How Wage Theft Harms Pennsylvania's Workers and Economy

- Restaurant Opportunities Center United, 2012: "Behind the Kitchen Door: The Hidden Reality of Philadelphia’s Thriving Restaurant Industry"

Rhode Island

- Fuerza Laboral/Power of Workers, 2013: "Shortchanged: A study of non-payment of wages in Rhode Island"

Texas

- Workers Defense Project, University of Texas-Austin, University of Illinois-Chicago, 2013: "Build a Better Texas"

- Houston Interfaith Worker Justice Center/Fe y Justicia Worker Center, 2012: "Houston, We Have a Wage Theft Problem"

References

- ↑ 1.0 1.1 1.2 1.3 National Employment Law Project, "Winning Wage Justice: A Summary of Criminal Prosecutions of Wage Theft in the United States," research summary report, July 2013. Accessed July 16, 2014.

- ↑ Annette Bernhardt, Ruth Milkman, Nik Theodore, Douglas Heckathorn, Mirabai Auer, James DeFilippis, Ana Luz Gonzalez, Victor Narro, Jason Perelshteyn, Diana Polson, and Michael Spiller, "Broken Laws, Unprotected Workers," UCLA/UIC Unprotected Workers Project report, accessed July 16, 2014.

- ↑ 3.0 3.1 David Streitfeld, "Engineers Allege Hiring Collusion in Silicon Valley," New York Times, February 28, 2014. Accessed July 16, 2014.

- ↑ 4.0 4.1 Dan Levine, "Exclusive: Apple, Google to pay $324 million to settle conspiracy lawsuit," Reuters, April 24, 2014. Accessed July 16, 2014.

- ↑ U.S. Senate Health, Education, Labor, and Pensions Committee, "Acting Responsibly? Federal Contractors Frequently Put Workers’ Lives and Livelihoods at Risk," Majority Committee Staff Report, December 11, 2013. Accessed July 21, 2014.

- ↑ "Wage Theft in State Higher than All Kentucky Robberies Combined," River City News, August 29, 2014. Accessed September 3, 2014.

- ↑ Ross Eisenbrey, "Wage Theft is a Bigger Problem Than Other Theft—But Not Enough is Done to Protect Workers," Economic Policy Institute, April 2, 2014. Accessed July 16, 2014.

- ↑ Barbara Ehrenreich, "How Corporations and Local Governments Use the Poor As Piggy Banks," Mother Jones, May 18, 2012. Accessed July 17, 2014.

- ↑ Wage and Hour Division, U.S. Department of Labor, Our Mission, organizational website, accessed July 16, 2014.

- ↑ 10.0 10.1 10.2 Zoe Carpenter, "Low-Wage Workers’ Newest Ally Is a Washington Bureaucrat," The Nation, July 1, 2014. Accessed July 16, 2014.

- ↑ Alejandra Cancino, "Labor Department issues guidance on classifying workers," Chicago Tribune, July 15, 2015.

- ↑ David Weil, "Employee or Independent Contractor?," U.S. Department of Labor Blog, July 15, 2015.

- ↑ Department of Labor, David Weil, organizational website, accessed July 16, 2014.

- ↑ 14.0 14.1 Katie Johnston, "BU professor takes on task of enforcing US wage laws," Boston Globe, June 8, 2014. Accessed July 16, 2014.

- ↑ U.S. Government Accountability Office, "Wage and Hour Division's Complaint Intake and Investigative Processes Leave Low Wage Workers Vulnerable To Wage Theft," government report, March 25, 2009. Accessed July 16, 2014.

- ↑ Steven Greenhouse, "Labor Agency Is Failing Workers, Report Says," New York Times, March 24, 2009. Accessed July 16, 2014.

- ↑ Antonia Blumberg and Yasmine Hafiz, "Yes, Religion Can Still Be A Force For Good In The World. Here Are 100 Examples How," Huffington Post, June 17, 2014. Accessed July 17, 2014.

- ↑ Interfaith Worker Justice, History, organizational website, accessed July 17, 2014.

- ↑ Aruna Ranganathan, "Book review: Wage Theft in America," Perspectives on Work, Massachusettes Institute of Technology, Summer 2009. Accessed July 17, 2014.

- ↑ Interfaith Worker Justice, Interfaith Affiliates, organizational website, accessed July 17, 2014.

- ↑ Jobs With Justice, About Us, organizational website, accessed July 22, 2014.

- ↑ Jobs With Justice, Our History, organizational website, accessed July 22, 2014.

- ↑ Jobs With Justice, Our Network, organizational website, accessed July 22, 2014.

- ↑ National Employment Law Project, Background, organizational website, accessed July 16, 2014.

- ↑ Open Societies Foundation, National Employment Law Project, grantee profile, accessed July 16, 2014.

- ↑ Progressive States Network, About, organizational website, accessed July 22, 2014.

- ↑ American Legislative and Issue Campaign Exchange, ALICE Contributors, organizational website, accessed July 22, 2014.

- ↑ Katrina vanden Heuvel, "Building a Progressive Counterforce to ALEC," The Nation, April 11, 2012. Accessed July 22, 2014.

- ↑ ROC United, Our History, organizational website, accessed July 22, 2014.

- ↑ ROC United, Locations, organizational website, accessed July 22, 2014.

- ↑ Dignity at Darden, main page, organizational website, accessed July 22, 2014.

- ↑ Working America, Issues, organizational website, accessed July 22, 2014.

- ↑ 33.0 33.1 Josh Eidelson, "AFL-CIO's Non-Union Worker Group Headed Into Workplaces in Fifty States," The Nation, April 17, 2013. Accessed July 22, 2014.

- ↑ Josh Eidelson, "On the Road With Working America," The Nation, October 10, 2012. Accessed July 22, 2014.

- ↑ 35.0 35.1 Jane McAlevey, "Make the Road New York: Success Through 'Love and Agitation'," The Nation, May 21, 2013. Accessed July 16, 2014.

- ↑ Make the Road New York, Who We Are, organizational website, accessed July 16, 2014.

- ↑ 37.0 37.1 Make the Road New York, What We Do, organizational website, accessed July 16, 2014.

- ↑ Make the Road New York, "Cleaning Up NYC’s Filthy Car Wash Industry," press release, June 13, 2012. Accessed July 16, 2014.

- ↑ 39.0 39.1 39.2 Kirk Semple, "Queens Carwash’s Employees Are First in City to Join Union," September 9, 2012. Accessed July 16, 2014.

- ↑ New York State Department of Labor, "LABOR DEPARTMENT INVESTIGATION OF NEW YORK'S CAR WASH INDUSTRY UNCOVERS NEARLY $6.6 MILLION IN UNPAID WAGES ," press release, August 15, 2008. Accessed July 16, 2014.

- ↑ Make the Road New York, Consumer Abuse and Environmental Hazards in New York City’s Car Wash Industry, report, December 12, 2013. Accessed July 16, 2014.

- ↑ 42.0 42.1 42.2 Committee for Better Banks, "The state of the bank employee on Wall Street," research report, December 5, 2013. Accessed July 16, 2014.

- ↑ Danielle Douglas, "Low bank wages costing the public millions, report says," Washington Post, December 3, 2013. Accessed July 16, 2014.

- ↑ TakeAction Minnesota, About Us, organizational website, accessed July 16, 2014.

- ↑ TakeAction Minnesota, Work and Wealth, organizational website, accessed July 16, 2014.

- ↑ Mary Bottari and Rebecca Wilce, "Just How Low Can Your Salary Go? 117 ALEC Bills in 2013 Fuel Race to the Bottom in Wages and Worker Rights," Center for Media and Democracy, PR Watch, July 23, 2013. Accessed July 21, 2014.

- ↑ California Department of Industrial Relations’ Division of Labor Standards Enforcement, "California Labor Commissioner investigation results in charges against Santa Monica car wash," press release, January 23, 2013. Accessed July 16, 2014.

- ↑ Brenton Garen, "Wilshire West Car Wash: No Contest For Failure To Pay For Work Breaks," Santa Monica Mirror, November 13, 2013. Accessed July 16, 2014.

- ↑ Attorney General of New York, "A.G. Schneiderman Secures Guilty Plea From Suffolk Car Wash Boss Who Failed To Pay Minimum Wage," press release, May 22, 2013. Accessed July 16, 2014.

- ↑ 50.0 50.1 50.2 50.3 50.4 50.5 Greg B. Smith, "EXCLUSIVE: Construction firms sued by workers claiming wage theft still save millions under city tax break," New York Daily News, May 31, 2015.

- ↑ Charles V. Bagli, "In Program to Spur Affordable Housing, $100 Million Penthouse Gets 95% Tax Cut," The New York Times, February 2, 2015.

- ↑ U.S. Department of Labor, "US Labor Department recovers nearly $3M in back wages for workers on federally funded construction projects in New York City," press release, December 11, 2014.

- ↑ Tom Juravich, Essie Ablavsky, and Jake Williams, "The Epidemic of Wage Theft in Residential Construction in Massachusetts," working paper series, University of Massachusetts-Amherst, May 11, 2015.

- ↑ 54.0 54.1 54.2 Mandy Locke and Franco Ordoñez, "Taxpayers and workers gouged by labor-law dodge," The State, September 4, 2014. Accessed October 14, 2014.

- ↑ Mandy Locke and Franco Ordoñez, "Why is worker misclassification a problem?," The State, September 4, 2014. Accessed October 14, 2014.

- ↑ Mandy Locke, David Raynor, Rick Rothacker and Franco Ordoñez, "http://www.mcclatchydc.com/static/features/Contract-to-cheat/467-million-dollar-problem.html?brand=sta NC’s $467 million problem: Abuse of workers, failure to collect taxes]," The State, September 5, 2014. Accessed October 14, 2014.

- ↑ San Francisco Attorney General, "City Contractor Charged with Cheating Employees Out of Over $600,000 in Wages and Failing to Pay Over $100,000 in Workers’ Compensation Insurance Premiums," January 27, 2012. Accessed July 16, 2014.

- ↑ California Attorney General, Attorney General Brown Files Charges Against Granite Bay Concrete Company for Tax Evasion and Insurance Fraud," press release, November 30, 2010. Accessed July 16, 2014.

- ↑ Max B. Baker, "Hotel employees forced to work ‘off the clock’," Star-Telegram, March 5, 2015.

- ↑ Michelle Chen, "Restaurant Workers Fight Unsavory Conditions, Wage Theft, Racism and More at Capital Grille," In These Times/Alternet, July 29, 2012. Accessed July 22, 2014.

- ↑ Dignity at Darden, Darden Complaint, organizational website, accessed July 22, 2014.

- ↑ Lisa Baertlein, "Workers to hit Darden with wage, discrimination claims," Reuters, January 31, 2012. Accessed July 22, 2014.

- ↑ Dignity at Darden, Darden Complaint, organizational website, accessed July 22, 2014.

- ↑ 64.0 64.1 Steven Greenhouse, "McDonald’s Workers File Wage Suits in 3 States," March 14, 2014. Accessed July 17, 2014.

- ↑ Emily Jane Fox, "McDonald's workers sue for wage theft," CNN, March 13, 2014. Accessed July 17, 2014.

- ↑ Office of the General Counsel, NLRB Office of the General Counsel Authorizes Complaints Against McDonald's Franchisees and Determines McDonald's, USA, LLC is a Joint Employer," National Labor Relations Board, July 29, 2014. Accessed July 30, 2014.

- ↑ Steven Greenhouse, "McDonald’s Ruling Could Open Door for Unions," New York Times, July 29, 2014. Accessed July 30, 2014.

- ↑ Julie Jargon, "McDonald's Ruling Sets Ominous Tone for Franchisers," Washington Post, July 29, 2014. Accessed July 30, 2014.

- ↑ Dave Jamieson, "Subway Franchisee Invented Fictional Workers To Avoid Paying Overtime: Lawsuit," Huffington Post, August 8, 2014. Accessed August 12, 2014.

- ↑ Jessica Silver-Greenberg and Stephanie Clifford, "Paid via Card, Workers Feel Sting of Fees," New York Times, July 1, 2013. Accessed August 27, 2014.