MERS

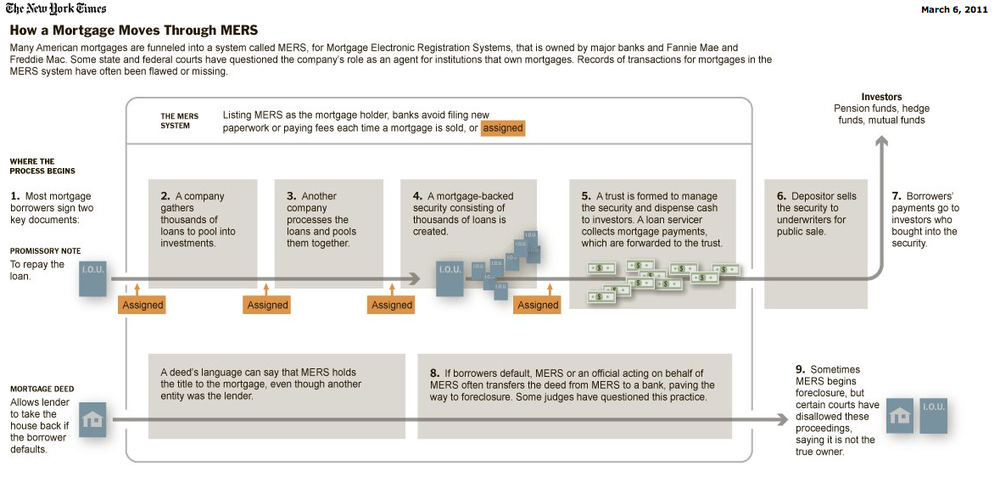

The Mortgage Electronic Registration System, or MERS, tracks more than 65 million mortgages throughout the United States,[1] and is listed as the mortgagee for 60 percent of U.S. mortgages.[2]Incorporated in October 1995,[3]MERS sought to reduce the costs and inefficiencies associated with the traditional property registration system that had existed since the pre-colonial era. Since then, MERS’s private mortgage registry has essentially replaced the nation’s public land ownership records, and its central role in the mortgage industry has garnered the criticism of judges, lawmakers, lawyers, and housing experts as a result of the collapse of the U.S. housing bubble.[4] MERSCORP collects membership fees and per-transaction fees from financial institutions for access to the MERS database, and as compensation for claiming to own the mortgages registered by investment banks.[5]

Contents

Traditional Title Conveyance System

Historically, each United States county has maintained its own records of who owns the land within that county.[6] This included tracking changes in ownership of land, including mortgages and deeds of trust, by maintaining records indexed through the names of grantors and grantees.[7] Community-elected county recorders or registers of deed kept grantor-grantee indexes that allowed individuals to investigate whether a seller or mortgagor actually owns the land that the person is offering for sale or mortgage.[8] To facilitate this service, county recorders have charged fees of about $35.00 on documents they record. These fees are typically used to fund county recorder offices and to contribute to county and state revenue.[9] In some counties, real property recording fees are used to fund other county departments such as courts, legal aid offices, schools, and police departments.[10] Prior to the incorporation of MERS, county record keepers provided an authoritative, public record of homeownership. The questionable legality and secrecy of the MERS system prompted county officials to appeal to Congress, but their effort failed due to an industry wide culture of deregulation.[11] The words of Mark Monacelli, a St. Louis County recorder in Duluth, Minn., capture the sentiment of county officials at the time: ““We lost our revenue stream, and Americans lost the ability to immediately know who owned a piece of property.”[12]

Creation of MERS

1993 White Paper

In 1993, the Mortgage Bankers Association of America authorized the InterAgency Technology Task Force to publish the Whole Loan Book Entry White Paper, outlining the MERS concept and its potential industry benefits.[13] The White Paper was published at the MBA’s Annual Convention, and was used afterwards as the primary vehicle for soliciting comments from the real estate finance industry on the MERS concept.[14] The paper argued for the need to modernize the trading of mortgages, and consequently the elimination of mortgage assignments, which had become an obstacle in the industry’s effort to cut costs associated with mortgage securitization.[15] The system of moving mortgage documents by hand and mail made it difficult for banks to bundle home loans and sell them to investors.[16] According to University of Utah Law Professor Christopher Peterson, “Because the new system cut out payment of county recording fees, recording was significantly cheaper for intermediary mortgage companies and the investment banks that packaged mortgage securities. Acting on the impulse to maximize profits by avoiding payment of fees to county governments, much of the national residential mortgage market shifted to the new proxy recording system in only a few years.”[17]

Banking Industry Support

According to University of Utah Law Professor Christopher Peterson, “In the mid-1990s some mortgage bankers decided they did not want to pay recording fees for assigning mortgages anymore. Securitization—a process of pooling many mortgages into a trust and selling income from the trust to investors on Wall Street—drove this decision…To avoid the hassle and expense of paying country recording fees these mortgage bankers formed a plan to create one shell company that would pretend to own all the mortgages in the country.”[18]The InterAgency Technology Task Force that published the original White Paper consisted of representatives from Fannie Mae, Freddie Mac, the Mortgage Bankers Association of America, and Ginnie Mae.[19]Although these organizations and major investment banks such as JPMorgan Chase and Bank of America touted the registry as a way to streamline mortgage processing, they didn’t conceal their main goal of maximizing profits. In the year prior to the inception of MERS, the estimated cost of preparing, recording, and mailing 11.1 million loan documents totaled about $210 million.[20] University of Missouri Economics Professor L. Randall Way summarizes the culture of deregulation and easy profits that led to the creation of MERS: “Wall Street wanted to transform America's housing sector into the world's biggest casino and needed to undermine property rights to make it easier to run the scam. The payoffs were bigger for lenders who could induce homeowners to take mortgages they could not possibly afford. The mortgages were packaged into securities sold-on to patsy investors who were defrauded by the “reps and warranties” falsely certifying the securities as backed by top grade loans. In fact the securities were not backed by mortgages, and in any case the mortgages were sure to go bad. Given that homeowners would default, the Wall Street banks that serviced the mortgages needed a foreclosure steamroller to quickly and cheaply throw families out of the homes so that they could be resold to serve as purported collateral for yet more gambling bets. MERS—the industry's creation--stepped up to the plate to facilitate the fraud. The judge has ruled that its practices are illegal. MERS and the banks lose; investors and homeowners win.”[21]

Angelo Mozilo

Countrywide Financial executive Angelo Mozilo is often referred to as the inspiration for the system that would eventually become MERS. In 1992, Mozillo, a much-admired and well-respected Mortgage Bankers Association of America board member, began devising systems to computerize and centralize industry operations along with technology expert Brian Hershkowitz.[22] In 2010 Mozilo paid a $67.5 million settlement to the Securities and Exchange Commission over securities fraud and insider trading charges stemming from allegations he doled out risky mortgages while misleading investors about the risks.[23]

MERS System

MERS Controversy

Documentation

MERS does not keep digital or hard copies of documents that formalize a loan’s change of beneficial ownership interest, which makes tracking fraud and errors through their record system extremely difficult.[24]

University of Missouri-Kansas City Associate Professor William K. Black summarizes MERS’s difficulties with retaining the requisite physical documentation:

“MERS' members have endemic, severe problems with mortgage documentation. They originated, purchased, or agreed to service loans and collateralized debt obligations (CDOs) without the underlying mortgage note. Fraud begets fraud. The exceptional incidence of underlying mortgage origination fraud led to widespread failure to prepare and maintain proper documentation – and that was before the mortgage originators failed. When the mortgage originators failed, as they did by the hundreds, mortgage documents were frequently thrown away. Mortgage documentation became particularly defective because originators could sell mortgages without the purchaser even checking whether the seller was delivering the original note.”[25]

From University of Utah Law Professor Christopher Peterson:

“After seeing loan after loan in her court room with incomplete documentation and incoherent transactional records, Judge Jennifer Bailey, a Circuit Court Judge in Miami, recently stated the following:'There are 60,000 foreclosures filed last year. Every single one of them—almost every single one of them—represents a situation where the bank’s position is constantly shifting and changing because they don’t know what the Sam Hill is going on in their files.'"[26]

MERS relies on its members to enter beneficial ownership rights information into its system instead of systematically tacking these transactions.[27] Because MERS gives discretion to financial institutions to choose whether or not to reveal themselves or update changes in loan ownership, there is a lack of coherent, reliable documentation that makes tracking fraud and errors in the system nearly impossible.[28]As the Washington Post explains, ““The first thing to go was the vault for keeping documents. MERS instead became a giant electronic card catalogue that tracked who was managing a particular loan as it was sold and resold, but it left the companies responsible for guarding the mortgage (or deed of trust) and the promissory note (or IOU) - the two critical pieces of paper that prove who owns a loan.”[29]

Staff

MERS has a full-time staff of fewer than 50 employees, a corporate structure Christopher Peterson refers to as both “unorthodox” and “fraudulent.”[30] The unusual system helps MERS minimize costs, but prevents them from checking its members’ quality, ability, or integrity.[31] The company’s modest size means it does not have the personnel to handle legal problems created by its hypothetical ownership of millions of home mortgages.[32] MERSCORP accommodates the massive amount of paperwork and litigation resultant from its business model by farming out their corporate identity to employees of mortgage servicers, originators, debt collectors, and foreclosure law firms.[33] Financial companies are able to enter names of their own employees into a MERS webpage that spits out corporate resolutions certifying them as either “assistant secretaries” or “vice presidents” of MERS. Moreover, these same financial institutions and law firms pay MERS to allow various organizations to assume fake status as MERS employees.[34] At least 20,000 “vice presidents” and “assistant secretaries” exist within the MERS corporate structure, which fuels inconsistincies, conflicts of interest, and general confusion.[35]

County Recording Fees And State Budget Crises

Securitization agreements under the MERS system have employed false documents and qualifying language to avoid paying government fees, a practice akin to tax fraud.[36] By representing themselves as the owners of a mortgage lien, MERS in turn forces the county recorders that maintain grantor-grantee indexes to list MERS in the chain of title for the land. The entire purpose of recording mortgages and deeds of trust is thus defeated because the false designation of MERS as a mortgagee ruins the true chain of title. The recording of these documents also reduces the revenue collected by county governments from mortgage financiers, a consequence marketed by MERS in sales pitches and marketing materials. Christopher Peterson suggests that county governments could use the legal principles of “unjust enrichment” and “judicial estoppel” to recover unpaid county recording fees from MERS. By arguing for unjust enrichment, counties could claim restitution for the reasonable value of unfairly received property or services by pointing out that, “[T]he investment banks that sold mortgage loans into securitization trusts attempted to avail themselves of the benefit of selling a properly recorded mortgage without paying the costs of properly recording.”[37] Here, the investment banks have implicated themselves in the budget crises afflicting local governments across the country. Counties have been forced to lay off teachers, firefighters, police officers, and infectious disease clinic workers as financial institutions defend the likely unlawful practice of recording false documents to avoid paying modest fees to the government. Counties may also go about recovering recording fees by arguing that MARS and its members should be judicially estopped from denying liability for unpaid recording fees. The allegation is made possible because courts tends to use estoppel where the party making inconsistent representations accepts some benefit from the misrepresentation.[38]

Dual Nominee And Mortgagee Status

On many mortgage security agreements, MERS purports to act as both a “nominee,” a form of agent, as well as the actual mortgagee, which purportedly gives them the right to foreclose upon the security interest.[39] MERS’s proposed dual status presents an array of legal problems, and attorneys representing the company have frequently shifted their positions on the status of the company to accommodate different legal issues.[40] State land title recording acts exist to provide a transparent, reliable record of land ownership, but if MERS is merely an agent of the lender, then the source of its authority to list itself as a mortgagee or deed of trust beneficiary under state land title recording acts is unclear. According to Yves Smith, ““Although critics have provided a number of arguments against MERS, the most fundamental relate to MERS’ claim that it acts as mortgagee of record. While the language it uses to register mortgages in the name of MERS in local courthouses says it is both the nominee for the mortgagee and the mortgagee (a legal impossibility), in depositions its executives have repeatedly said that MERS is the mortgagee. In 45 states, that position would seem to be a non-starter. In those states, the note (the borrower IOU) is the critical document; in these states, the mortgage is a mere “accessory” to the note and has no independent force. Indeed, in these states, you cannot be a mortgagee unless you are also the creditor. But in depositions, MERS has repeatedly acknowledged that it does not lend money and does not collect interest payments. But MERS effectively takes the position that you can separate the mortgage from the note and reunite them, a position that was rejected in an 1873 Supreme Court decision, Carpenter v. Longan (Carpenter v. Longan, 83 U.S. 271, 21 L.Ed. 313 [1873])):”[41]

Chain of Ownership

One of the motivations for creating MERS was the notion among mortgage bankers that the time-consuming and ultimately costly chore of re-recording the ownership of individual mortgages was holding back wider securitization.[42]The current MERS system of servicer identification often does not reveal any helpful information regarding the beneficial ownership of loans, and instead issues the following message: “Investor: This investor has chosen not to display their information. For assistance please contact the servicer.”[43] This creates confusion as to whether the most prevalent recording system in the country actually fails to track legally recognized ownership interests, or whether the owner of the loan actually refuses to be identified.[44] A statement from the District of Columbia Office of the Attorney General noted that, “[T]he MERS registry does not allow users to confirm that reported noteholder interests are supported by a chain of conveyances originating with the maker of the note.” Last year, Alan M. White, a law professor at Valparaiso University School of Law in Indiana, attempted to match MERS’ ownership records against those in the public domain. His results speak to the company’s attempts at obfuscating what was once an accessible, understandable corps of information: ““Fewer than 30 percent of the mortgages had an accurate record in MERS. I kind of assumed that MERS at least kept an accurate list of current ownership. They don’t. MERS is going to make solving the foreclosure problem vastly more expensive.”[45] MERS simply does not disclose to consumers the chain of ownership linking the original lender to the current owner of the loan, or copies of documents that purport to transfer ownership interests in the land. The missing information also upsets the integrity of county real property records, which have systemic breaks in chains of title when they only hold a reference to the MERS system. Court cases have arisen in recent years accusing MERS of benefiting its members by “removing the burden of documenting” and facilitating ownership disputes.[46] In 2009, a Florida mortgage origination and servicing company called Diversified Mortgage, Inc., filed a lawsuit against MERS to resolve uncertainty over ownership of Florida mortgages registered on the MERS system, alleging that “[T]he system implemented by MERS has essentially privatized the mortgage records while undermining the value of county public records.[47] No longer can a homeowner visit a government office, review the public records, and learn the identity of who actually owns his mortgage.” Diversified also discovered that third party financial institutions had begun foreclosure proceedings on mortgages Diversified believed it owned.[48]

Court Cases

Landmark National Bank v. Kesler (Kansas)

In August 2009, the Kansas Supreme Court ruled that MERS had no interest in the underlying property of a bankrupt borrower whose home was auctioned, despite their representation as the mortgage.[49] The Court invalidate the MERS transfer of the mortgage on the grounds that its owner, Sovereign, had never recorded its interest in Ford County. The Kansas Supreme Court wrote the following with regard to MERS’ self-characterization as both nominee and mortgage: ““The relationship that MERS has to Sovereign [Bank] is more akin to that of a straw man than to a party possessing all the rights given a buyer… What meaning is this court to attach to MERS’s designation as nominee for Millennia [Mortgage Corp.]? The parties appear to have defined the word in much the same way that the blind men of Indian legend described an elephant — their description depended on which part they were touching at any given time. Counsel for Sovereign stated to the trial court that MERS holds the mortgage ‘in street name, if you will, and our client the bank and other banks transfer these mortgages and rely on MERS to provide them with notice of foreclosures and what not.’ ” The court continued: “MERS did not demonstrate, in fact, did not attempt to demonstrate, that it possessed any tangible interest in the mortgage beyond a nominal designation.”

Mortgage Electronic Registration System, Inc. v. Southwest Homes of Arkansas (Arkansas)

Christopher Peterson neatly summarizes the case and its implications: “In Mortgage Electronic Registration System, Inc. v. Southwest Homes of Arkansas, a first position named MERS as the beneficiary on its deed of trust. Later the borrower took out a second mortgage that did not use the MERS system. When the borrower fell behind on the second mortgage, the subsequent lender’s assigneee foreclosed without notifying either MERS or the real owner of the first mortgage. When MERS, acting through local counsel, attempted to set aside the foreclosure, a unanimous Supreme Court of Arkansas, with its Chief Justice writing, held that MERS had no property rights with respect to the loan. Even though MERS never had service of process, the court allowed the foreclosure to stand because MERS had lost nothing. In the court’s words, ‘MERS is not the beneficiary, even though it is so designated in the deed of trust.’”

MERS v. Saunders (Maine)

In Mers v. Saunders, the Maine Supreme Court took up the question of whether MERS had standing to bring a foreclosure action on behalf of the real economic loan owner . Even though the language in the security agreement was designed to accommodate contrary positions, the court rejected MERS’s ownership claim, stating: “MERS is not a mortgagee…because it has no enforceable right in the debt obligation securing the mortgage.” Because MERS lacked standing, the court reversed summary judgment to give the borrower who filed the appeal an opportunity to “appropriately defend the foreclosure action against the real party in interest.” Essentially, the Court ruled that MERS cannot foreclose on homes because it does not own the loans.

Horace v. LaSalle (Alabama)

In 2011, an Alabama Circuit Court Judge overturned a non-judicial foreclosure action “based on the failure of the trust to comply with the terms of the pooling & servicing agreement.”[50]

Class Action Lawsuits

Class action lawsuits against MERS are pending in California, Nevada, and Arizona.

Personnel

Executive Team

- Paul F Bognanno, President & CEO

- Dan McLaughlin, Executive Vice President & Product Division Manager

- Bill Hultman, Senior Vice President & Corporate Division Manager

- Douglas Danko, Vice President, Customer Group Manager

- Janis L. Smith, Vice President, Corporate Communications[51]

- American Land Title Association

- Bank of America

- CCO Mortgage Corporation

- Chase Home Mortgage Corporation of the Southeast

- CitiMortgage, Inc.

- Commercial Mortgage Securities Association

- Corinthian Mortgage Corporation

- EverHome Mortgage Company

- Fannie Mae

- First American Title Insurance Corporation

- Freddie Mac

- GMAC Residential Funding Corporation

- Guaranty Bank

- HSBC Finance Corporation

- Merril Lynch Credit Corporation

- MGIC Investor Services Corporation

- Mortgage Bankers Association

- Nationwide Advantage Mortgage Company

- PMI Mortgage Insurance Company

- Stewart Title Guaranty Company

- SunTrust Mortgage, Inc.

- United Guaranty Corporation

- Washington Mutual Bank

- Wells Fargo Bank, N.A.

- WMC Mortgage Corporation[52]

Board of Directors

- Paul Bognanno, President and CEO, MERSCORP, Inc.

- Diane Citron, Senior Vice President, Director of Strategy for Mortgage Operations, Ally Financial, Inc.

- John Courson, President and CEO, Mortgage Bankers Association

- Joe Jackson, Senior Vice President, Wells Fargo Banks, N.A.

- Brian McCrackin, Director of Finance, CitiMortgage, Inc.

- Kurt Pfotenhauer, CEO, American Land

- Robert Reynolds, Executive Vice President, SunTrust Banks, Inc.

- Joseph Rossi, Senior Vice President, Operations and Technology, Freddie Mac

- Steve Stein, Senior Vice President, Homeownership Preservation and Partnerships, JPMorgan Chase & Co.

- Marianne Sullivan, Senior Vice President, Fannie Mae

- H.G. Waddell, Executive Vice President, United Guaranty Corporation

- Lawrence P. Wahsington, Chairman and CEO, Merrily Lynch Credit Corporation[53]

Contact Details

- MERS

- 1818 Library Street, Suite 300

- Phone: (800) 646-6377

- Fax: (703) 748-0183

Articles & Resources

References

- ↑ "Reston-based company MERS in the middle of foreclosure chaos", The Washington Post, October 8, 2010

- ↑ "Full catastrophe banking in 2011",The Cap Times, January 5, 2011

- ↑ "Company Overview", Bloomberg BusinessWeek

- ↑ "MERS? It May Have Swallowed Your Loan", The New York Times, March 5, 2011

- ↑ "Peterson, Christopher Lewis. ''Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ "MERS? It May Have Swallowed Your Loan" The New York Times, March 5, 2011

- ↑ "MERS? It May Have Swallowed Your Loan" The New York Times, March 5, 2011

- ↑ "Tracking Loans Through a Firm That Holds Millions",The New York Times, April 23, 2009

- ↑ "MERS v. Johnston 420-6-09 (2009)"

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ "How the mortgage clearinghouse MERS became a villain in the foreclosure mess" The Washington Post, December 30, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ "How the mortgage clearinghouse MERS became a villain in the foreclosure mess", The Washington Post, December 30, 2010

- ↑ "How the mortgage clearinghouse MERS became a villain in the foreclosure mess", The Washington Post, December 30, 2010

- ↑ "New York's US Bankruptcy Court Rules MERS's Business Model Is Illegal", Business Insider, Februaru 17, 2011

- ↑ [ http://www.washingtonpost.com/wp-dyn/content/article/2010/12/30/AR2010123003056_pf.html "How the mortgage clearinghouse MERS became a villain in the foreclosure mess"], The Washington Post, December 30, 2010

- ↑ "How the mortgage clearinghouse MERS became a villain in the foreclosure mess", The Washington Post, December 30, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ [http://www.benzinga.com/economics/11/03/906223/the-unanticipated-consequences-of-mers#ixzz1FwrITcwg "The Unanticipated Consequences of MERS "]

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Ariana Eunjung Cha and Steven Mufson,"How the mortgage clearinghouse MERS became a villain in the foreclosure mess", The Washington Post, December 30, 2010.

- ↑ Michael Powell and Gretchen Morgenson, "MERS? It May Have Swallowed Your Loan", The New York Times, March 5, 2011.

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Yves Smith. "Why Mers Needs to Be Taken Out and Shot"

- ↑ Ariana Eunjung Cha and Steven Mufson. "How the mortgage clearinghouse MERS became a villain in the foreclosure mess"

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Michael Powell and Gretchen Morgenson, "MERS? It May Have Swallowed Your Loan", The New York Times, March 5, 2011.

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Peterson, Christopher Lewis. Two Faces: Demystifying the Mortgage Electronic Registration System’s Land Title Theory September 19, 2010

- ↑ Ariana Eunjung Cha and Steven Mufson,"How the mortgage clearinghouse MERS became a villain in the foreclosure mess", The Washington Post, December 30, 2010.

- ↑ Yves Smith. "Alabam Judge Accepts New York Trust Theory Dismess Foreclosure Action"

- ↑ "MERS About Us"

- ↑ "MERS About US"

- ↑ "MERS About US"