Employment Policies Institute

The Employment Policies Institute (EPI) is one of several front groups created by Berman & Co., a Washington, DC public affairs firm owned by Rick Berman, who lobbies for the restaurant, hotel, alcoholic beverage and tobacco industries. While most commonly referred to as EPI, it is registered as a 501(c)(3) tax-exempt organization under the name of "Employment Policies Institute Foundation." In its annual Internal Revenue Service return, EPI states that it "shares office space with Berman & Company on a cost pass through basis".[1]

Contents

News and Controversies

Creation of "Rethink Reform"

In 2009, EPI created a group called Committee to Rethink Reform and started running television, print, and radio advertisements to mobilize opposition to the Democrats' health care reform legislation. The group is a 501 (c)4 organization and subsequently not required to disclose its donors--one of the hallmarks of a Rick Berman-operated group. The group has its own Web site and Facebook page. Here, among other things, are some of their claims, which have been repeated in anti-reform politicians' talking points:

"When it comes to reforming the health care system, Congress is trying to do too much, too fast. Not everyone agrees that we need reform of America’s health care system. Unfortunately, Congressional leaders are cutting backroom deals with special interest groups and writing bills that will lead to higher taxes, higher insurance premiums and fewer health care choices. The solution is not more government intrusion into the health care system, but less. It’s time for Congress to rethink health care reform, focusing on: Increasing health care choices; Reining in health care costs; and Controlling the growth of government to avoid escalating the national debt."

In 2010, they launched another print and TV advertising campaign against health care reform. The group faced controversy in March 2010 when it ran an advertisement in The Cincinnati Enquirer featuring a large picture of Representative Steven Driehaus (D-OH) and his two daughters. According to his spokesman, Driehaus was upset by the ad: "Rep. Driehaus thought the ad was outrageous, said the spokesman, Tim Mulvey. "He can take more than his fair share of political attacks, but this one crossed the line" [1]. Committee spokeswoman Sarah Longwell said showing the children was a mistake and that the group was taking out another ad to apologize: "...Politicians' children should bot be involved in public political debates and we deeply regret this mistake." Longwell said the committee already apologized directly to Driehaus. The Committee to Rethink Reform reported its apology on its Web site, while stating it would continue to urge Driehaus to oppose the bill [2].

The Center for Media and Democracy, which publishes SourceWatch.org, is looking into the nature of the claims they are making and their funding.

They have also spent substantial funds on ads in other right-wing campaigns, as described below.

Advertising against ACORN

In October 2008, as Republicans were accusing ACORN, which organizes in low-income communities, of "voter fraud," EPI took out a full-page ad in the New York Times that directed readers to www.RottenAcorn.com. The ad accused "ACORN of a list of abuses that suggest hypocrisy on some of the group's signature issues: intimidating and firing its own employees if they try to unionize, misappropriating millions of dollars from taxpayer-funded government grants and advocating minimum wage hides while paying its own employees less than minimum wage," reported ProPublica. EPI and Center for Consumer Freedom spokesperson Tim Miller said they placed the ad because after the election, "a lot of the coverage of ACORN is going to go away, but they are going to continue the same corrupt and fraudulent practices." [2]

For years, EPI had fought "ACORN's efforts to increase the minimum wage at the state and federal levels." ACORN says the charges in EPI's are untrue. For example, the group "pledged complete neutrality" when one of its offices "wanted to form a union," explained ACORN's Steve Kest. The employees eventually "decided not to pursue [the union], so nothing came of it." [2]

Against Raising the Minimum Wage

Rick Berman created EPI in 1991 to "argue the importance of minimum wage jobs for the poor and uneducated."[3] EPI's activities opposing minimum wage increase are described below.

EPI also owns the internet domains MinimumWage.com and LivingWage.com, a website that attempts to portray the idea of a living wage for workers as some kind of insidious conspiracy. "Living wage activists want nothing less than a national living wage," it warns (as though there is something wrong with paying employees enough that they can afford to eat and pay rent).

L.A. County Supervisor Pays EPI $55,000 for Minimum Wage "Study" (2015)

At the end of June 2015, Los Angeles County Supervisor Mike Antonovich hired EPI "to conduct a survey of employers, analyze the impact of a minimum wage hike, and analyze complex annexation issues, among other topics," all to be completed by July 17 at a cost of $55,000 to L.A. taxpayers, as reported by Peter Dreier, E.P. Clapp Distinguished Professor of Politics at Occidental College. As Dreier writes, "what Antonovich asked for would be an impossible task on that budget and timeline for any research organization."[4] According to the L.A. Times, EPI ended up conducting a telephone survey that "came up with starkly different results" than a survey conducted by L.A. County staff of small businesses in unincorporated areas of the county; the Times, which described EPI as "a conservative think-tank," did not describe the survey's methodology.[5] The L.A. County Board of Supervisors voted on July 21 to raise the minimum wage to $15 by 2020.[6]

Ad Campaign Against Minimum Wage Increase (2014)

In April 2014, EPI began an ad campaign in Washington, DC against the proposed minimum wage increase.[7] It includes a TV ad with a fortune teller who tells an actor portraying President Obama that “It doesn’t take a fortune teller to know what happens when you raise the minimum wage,” a radio commercial, and a mobile billboard on Pennsylvania Avenue between the Capitol and White House.

In February 2014, EPI ran a full-page ad in the New York Times attacking the over 600 economists who publicly favor raising the minimum wage to $10.10 an hour, who had been referenced by President Barack Obama, Sen. Tom Harkin (D-IA), and the New York Times editorial board. The ad said, "Many of the 600 economists you rely on are radical researchers or full-time employees working at union-backed groups. Of those who support a higher minimum wage, 45 percent don't specialize in labor economics."[8] An article published by Businessweek the same day pointed out, "The vast majority of the letter’s signers, organized by the labor-backed Economic Policy Institute, are in the mainstream of the profession. They include some of the most prominent living economists, including seven Nobel Prize winners and eight former presidents of the American Economic Association."[9]

EPI has has been widely quoted in news stories regarding minimum wage issues, and although a few of those stories have correctly described it as a "think tank financed by business," most stories fail to provide any identification that would enable readers to identify the vested interests behind its pronouncements. Instead, it is usually described exactly the way it describes itself, as a "non-profit research organization dedicated to studying public policy issues surrounding employment growth" that "focuses on issues that affect entry-level employment." In reality, EPI's mission is to keep the minimum wage low so Berman's clients can continue to pay their workers as little as possible.

Plans to Spend $500,000 on Commercial Attacking Wage Increase (2013)

In March 2013, EPI started running the commercial attacking the minimum wage. The commercial opposing President Obama's effort to hike the minimum wage touts the report by the Congressional Budget Office released Tuesday, saying "up to one million jobs will disappear" if the minimum wage increases. The group plans to spend between $500,000 and $1 million on an "educational campaign" on the minimum wage. [10]

Berman Non-Profit Groups

In a February 2014 interview with NPR, New York Times reporter Eric Lipton detailed his visit to the EPI, saying "I didn't see any evidence at all that there was an Employment Policies Institute office. And in fact when I started to interview the people there, they explained that there are no employees at the Employment Policies Institute and that all the staff there works for Berman and Company, and then they sometimes are just detailed to the various think-tanks and various consumer groups that he operates out of his office."[11]

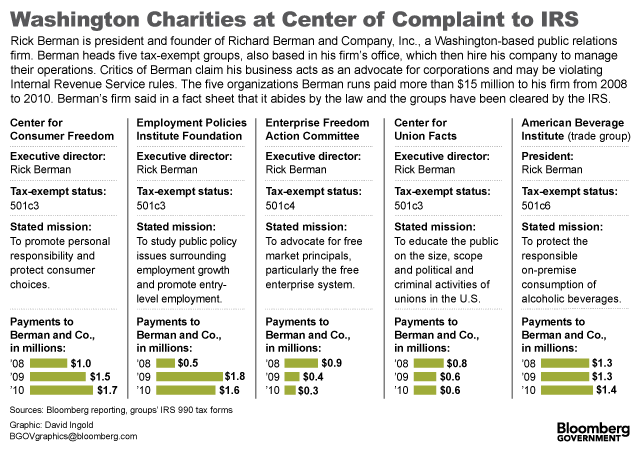

A November 1, 2012 article in Bloomberg shows CCF in the following chart of non-profits created by Berman & Co. at the center of an IRS complaint filed in 2012 (used with permission):

History

The Employment Policies Institute was launched in 1991, around the time of the economic recession that led to the electoral defeat of then-president George Bush. EPI deliberately attempted to create confusion in the eyes of journalists and the general public by adopting a name which closely resembles the Economic Policy Institute, a much older, progressive think tank with ties to organized labor. In addition to imitating the name and acronym of the Economic Policy Institute, Berman's outfit even used the same typeface for its logo. In reality, the two groups have dramatically different public policy agendas. The Economic Policy supports a living wage and mandated health benefits for workers. Berman's organization opposes both and in fact opposes any minimum wage whatsoever.

In 1992, Los Angeles Times business columnist Harry Bernstein noted that EPI was using "misleading studies" to help put a positive spin on rising unemployment. "The conservative EPI, financed mostly by low-wage companies such as hotels and restaurants, is issuing reports the titles of which alone could help put a bright face on the miserable job scene," Bernstein wrote. "The latest one is 'The Value of Part-Time Workers to the American Economy.' It hails as a great thing the distressing growth of part-time jobs because they offer 'flexibility' in economic planning for both workers and companies, and say that flexibility is vital 'in the growing and increasingly competitive global economy.' Tell that nonsense to the more than 6.5 million workers forced to take part-time jobs because nothing else is available. That is an increase of more than 1.5 million involuntary part-timers since 1990, the Bureau of Labor Statistics says." EPI has been doing more or less the same thing ever since, sponsoring cooked studies and issuing tendentious sound bytes whenever attempts are made to establish healthcare or better wages for workers.

Then, as now, fast-food employees were the largest group of low-paid workers in the United States. One-quarter of the workers in the restaurant industry are estimated to earn the minimum wage--a higher proportion than in any other U.S. industry. This is the real reason why EPI appears on the scene whenever federal or local governments consider a proposal to increase the minimum wage. Its standard tactic is to trot out a study using contrived statistics designed to show that hundreds of thousands of jobs will be lost if the wage is raised. (In reality, studies by labor economists show that the job-loss effect of increasing the minimum wage is either small or nonexistent and that its benefits to low-wage workers and their families far outweigh the costs. Even the Food Institute Report, an industry trade publication, admitted in 1995 that "the weight of the empirical evidence suggests that the effects [on the number of available jobs] of a moderate raise from its current level are likely to be negligible.")

Berman continued to fight against mandated insurance in 1992 and 1993, when president-elect Bill Clinton attempted to make health care reform one of his first legislative priorities. Berman created yet another front group, called the Partnership on Health Care and Employment, representing mostly large companies known for paying low wages and high worker turnover. It sponsored a study in 1992 claiming that compulsory insurance for business would wipe out nine million jobs. During the health reform debate in 1994, the Employment Policies Institute issued its own "study," claiming that the Clinton plan would wipe out 3.1 million jobs. The EPI study was cited in TV commercials sponsored by the Republican National Committee, which continued to air even after Berman admitted that his study had actually been produced before the Clinton administration even formulated the details of its health plan.

In 1995, EPI lashed out at Princeton University professors David Card and Alan Krueger, after they published a survey of fast-food restaurants which found no loss in the number of jobs in New Jersey after implementing an increase in the state's minimum wage. Berman accused Card and Krueger of using bad data, citing contrary figures that his own institute had collected from some of the same restaurants. But whereas Card and Krueger had surveyed 410 restaurants, Berman's outfit only collected data from 71 restaurants and has refused to make its data publicly available so that other researchers can assess whether it "cherry-picked" restaurants to create a sample that would support its predetermined conclusions.

In September 1999, Berman launched another group, the Employment Roundtable, to "build on the successes" of the EPI and to "find solutions for problems such as social security and health care." However, the Employment Roundtable has done nothing public of note.

The Employment Policies Institute in tobacco industry documents

The Employment Policies Institute, in a 1994 R.J. Reynolds-drafted press release, predicted the loss of 2-3 million jobs if the Clinton Healthcare plan was enacted. The Clinton plan was to be funded through an additional federal tax on cigarettes.[12]

A 1997 internal Philip Morris presentation called indicates PM planned to "sponsor and participate" in the Employment Policies Institute to gain the organization's help in promoting PM's Accommodation Program, a strategy the company designed to fight smoking bans and preserve smoking in public places.[13]

Affiliated organizations

In its 2005 IRS return, EPI lists the FirstJobs Institute as an organisation it is directly or indirectly affiliated with. (FirstJobs is designated as a 501(c)(6) organization by the IRS). In statement 15 of its IRS return, EPI describes the relationship as being for a "joint educational project, 'Econ4u'". Elsewhere it states that that EPI and the 'Institute' "shared free common office space and overhead expenses provided under the management agreement with Berman and Company". It also states that the Institute "solicited funds for the educational portion of the joint project on employment Policies Institute Foundation's behalf." [14]

Funding

EPI is not required to disclose its donors, but some of its funding sources are known through the IRS filings of other organizations. EPI's known funders include:

- American Hotel & Lodging Association: $15,000 (2019)

- Bradley Foundation: $4,050,000 (2009-2017)

- Donors Capital Fund: $88,000 (2015-2016)

- DonorsTrust: $1,091,500 (2006-2019)

- Farmer Family Foundation: $200,000 (2009)

- Fidelity Investments Charitable Gift Fund: $30,000 (2018)

- John William Pope Foundation: $80,000 (2016)

- Mile High United Way: $75,000 (2011)

- National Restaurant Association: $20,000 (2017)

- National Right to Work Legal Defense Foundation: $50,000 (2013)

- National Philanthropic Trust: $75,000 (2016)

- Searle Freedom Trust: $660,000 (2014-2019)

- State Policy Network: $306,000 (2018)

Core Financials

2019:[15]

- Total revenue: $1,799,010

- Total expenditures: $1,567,514

- Net assets: $592,071

2018:[16]

- Total revenue: $1,877,602

- Total expenditures: $2,190,580

- Net assets: $360,575

2017:[17]

- Total revenue: $1,112,670

- Total expenditures: $2,173,350

- Net assets: $673,553

2016:[18]

- Total revenue: $2,007,113

- Total expenditures: $2,379,477

- Net assets: $1,374,233

2015:[18]

- Total revenue: $1,941,944

- Total expenditures: $1,761,341

- Net assets: $2,106,340

2014:[19]

- Total revenue: $3,664,345

- Total expenditures: $2,615,979

- Payments to Richard Berman & Company for "Management, advertising, research & acct fees": $1,007,236

- EPI claimed only $6,154 in lobbying expenses for 2014.

- Net assets: $1,925,737

Grants Distributed

- Berman & Company's Center for Organizational Research and Education: $300,000 for "research groups and their impact on employment losses in the energy industry."

2013:[20]

- Total revenue: $2,347,584

- Total expenditures: $2,131,002

- Payments to Richard Berman & Company for "Management, advertising, research & acct fees": $1,044,056

- EPI claimed it had only $5 in lobbying expenses for 2013.

- Net assets: $877,371

2012:[21]

- Total revenue: $2,958,091

- Total expenditures: $2,357,088

- Payments to Richard Berman & Company for "Management, advertising, research & acct fees": $1,038,621

- EPI claimed it had $0 in lobbying expenses for 2012.

- Net assets: $660,789

Grants Distributed

- Martin Family Foundation: $5,286

2011:[22]

- Total revenue: $1,629,930

- Total expenditures: $2,103,896

- Payments to Richard Berman & Company for "daily monitoring/analysis on a worldwide basis on issues important to the organization, advertising, public and media relations, program management and promotion of information to the public": $1,165,601

2010:[23]

- Total revenue: $5,910,092

- Total expenditures: $7,054,260

- Payments to Richard Berman & Company: $1,630,104

Grants Distributed

- Berman & Company's Center for Union Facts: $257,548 for "educational issues regarding unionization of employees."

Previous Funding:

The IRS Form 990 for the year for the 2005 calendar year for the Employment Policies Institute Foundation states that its total revenue was $1,801,371. Of this $870,616 went to Berman & Company for "management services". The bulk of the group's expenses in 2005 were for PR related activities. $699,572 was spent on "media and message promotion", $229,069 on "marketing" and $324,618 on "issue research". [24] The same year, EPI gave $307,995 by way of grants to the FirstJobs Institute, which it describes as an "economic literacy program". [25]

The group's 2000 IRS return stated that the group received $1,163,248 in income for the year, most of which ($940,593) came from 17 anonymous donors. Of that amount, $717,812 went to Berman & Co. for "management services," and another $165,766 in salary and benefits went personally to Rick Berman. Comparable figures appear in EPI's Form 990 for previous years.

According to the Right Guide, funders of EPI have included the John M. Olin Foundation and the Claude R. Lamb Charitable Foundation.

Personnel

Staff

As of October 2021:

- Richard Berman, executive director

- Michael Saltsman, managing director

Directors and Officers

As of December 2019:[15]

- Richard B. Berman, President & Executive Director

- Gerald Francis, Secretary/Treasurer & Director

- Paul Avery, Director

- John Berglund, Director

- Shannon Foust, Director

- Warren Hardie, Director

- James R. Ledley, Director

Former Directors and Staff

- Craig Garthwaite, Director

- Sarah Longwell is a press contact for EPI and for the Center for Union Facts

- David Kreutzer, economist, who in 2008 wrote letters to newspaper op/ed pages arguing against minimum wage hikes and payday loan industry regulation[26][27]

Other individuals previously associated with EPI include:

- Thomas K. Dilworth, whose name appeared in some news stories as EPI's research director and was listed as a director on the groups 2000 IRS return;

- In 1999, EPI's Form 990 listed Ray Kraftson as a director.

- One of the trustees of EPI is Michael Morgan, personnel director for Northern Foods, a British-based food processing and manufacturing company.

- Richard Toikka, a member of the Republican National Lawyers Association, is also EPI's chief economist.[3]

- Restaurant magnate Norman Brinker has served as chairman of EPI. Brinker is the chairman and CEO of Brinker International. He is also the founder of the Steak and Ale restaurant chain, a former chairman of Burger King, and past President of the Pillsbury restaurant group (all of which are either former employers of Rick Berman or clients of Berman & Co.).

- Chris Sullivan, president and founder of Outback Steakhouses has served as chairman of EPI. According to an article in the New York Observer, Outback Steakhouses political aciton committee is a major sponser of the EPI. [4];

- John Doyle, communications director for Berman & Co., also serves as a spokesman for the EPI, as well as two other Berman organizations, the Center for Consumer Freedom and the American Beverage Institute.

- Kevin Lang of Boston University has authored a study sponsored by EPI.

- Jacob Dweck, Former Director

- Jeff Campbell, Former Director

Contact Information

Like other Berman & Co. front groups, EPI is headquartered at the following address:

Berman & Co.

1775 Pennsylvania Ave. NW, Suite 1200

Washington, DC 20006

Phone: 202 463 7650

FAX: (202) 463-7107

Email: rberman AT new-reality.com

Main website: http://www.epionline.org

- EPI's previous phone number, (202) 463-7110, was the same as for other Berman front groups such as the Center for Consumer Freedom.

- search google for above fax# "(202) 463-7107" [5]

Other websites

As of December 2019, EPI manages the following websites in addition to epionline.org:[15]

- http://www.minimumwage.com

- http://www.tippedwage.com

- http://www.facesof15.com

- http://www.policyalliance.org

- http://www.biasedberkeley.com

- http://www.econtrivia.com

- http://www.fightfor15.com

- http://www.ourindustryyourvoice.com

Former sites no longer listed on latest IRS filing:

- http://DefeatTheDebt.com

- http://Econ4U.org

- http://RethinkReform.com

- http://www.livingwage.org

- http://gatewayjobs.org

- http://econ4u.org

- http://livingwageresearch.com

- http://rottenacorn.org

- http://defeatthedebt.com

Articles and Resources

IRS Form 990s

2019

2018

2017

2016

Related PRWatch Articles

- Anne Landman, Rick Berman's For-Profit Non-Profits Under the Microscope, PRWatch.org, June 20, 2010.

- Anne Landman, Rick Berman Attacks the Humane Society, PRWatch.org, February 17, 2010.

- Sheldon Rampton and John Stauber, Berman & Co.: "Nonprofit" Hustlers for the Food & Booze Biz, PRWatch, First Quarter 2001, Volume 8, No. 1.

Related SourceWatch Articles

Other Berman Front Groups

- ActivistCash.com

- AFT Facts

- American Beverage Institute

- AnimalScam.com

- Bad Idea California

- Big Green Radicals

- Center for Consumer Freedom

- Center for Economic and Entrepreneurial Literacy

- Center for Organizational Research and Education

- Center for Union Facts

- CREW Exposed

- CSPI Scam

- Defeat the Debt

- EmployeeRightsAct.com

- Employment Policies Institute

- Enterprise Freedom Action Committee

- Environmental Policy Alliance

- EPA Facts

- Family Coalition

- First Jobs Institute

- Green Decoys

- Hands Off My Bacon

- Humane Society for Shelter Pets

- HumaneWatch.org

- Interlock Facts

- Interstate Policy Alliance

- LaborPains.org

- LEED Exposed

- Maternity Pens

- MinimumWage.com

- NegligentDriving.com

- No Drink Tax

- ObesityMyths.com

- PCRM Scam

- PETA Kills Animals

- Physician Scam

- Protecting Bad Teachers

- Responsible Limits

- Rethink Reform

- Rotten ACORN

- SEIU Exposed

- Step Up Wyoming

- Sweet Scam

- Teachers Union Exposed

- The New Prohibition

- Tipped Wage

- Unite Here Exposed

- Vote Our Future

- WorkerCenters

External Resources

- Humane Society of the United States, Richard Berman's Apparent Tax Scam, organizational IRS complaint website, launched November 2012.

External Articles

- Joe Fassler, "Does the Food Lobby Really Care about Freedom of Choice? Fuhgeddaboutit!, OnEarth Blog, November 13, 2012.

- Wayne Pacelle, "The Confidence Man, Unmasked, and Asked to Answer to the IRS, A Human Nation HSUS blog, November 2, 2012.

- Mark Drajem & Brian Wingfield, Union Busting by Profiting From Non-Profit May Breach IRS, Bloomberg, November 1, 2012.

- James Verini, "Bull Market: Forrest and Kimberly Smith Think New Yorkers Will Be Kookaburra for Their Cheap Steaks", New York Observer, August 20, 2001.

- Michael P., "Metro Center Advertising - Front Groups ," blog "Infosnack Headquarters," September 24, 2008.

References

- ↑ Employment Policies Institute Foundation, "Return of Organization Exempt from Income Tax", 2005, Statement 12.

- ↑ 2.0 2.1 Mosi Secret, "[http://www.propublica.org/article/rotten-acorn-ad-funded-by-anti-minimum-wage-group/ 'Rotten' ACORN Ad Funded by Anti-Minimum Wage Group]," ProPublica, October 29, 2008.

- ↑ Richard B. Berman Richard B. Berman Resume'. January 1995. Philip Morris Bates No. 2072148764

- ↑ Peter Dreier, "Why LA County Supervisor Mike Antonovich Hired a Phony Corporate-Backed 'Research' Firm to Kill the Minimum Wage Plan," Huffington Post, July 8, 2015.

- ↑ Abby Sewell, "L.A. County minimum wage hike poised to pass with Solis' support," L.A. Times, July 19, 2015.

- ↑ Abby Sewell, Jean Merl and Katie Shepherd, "L.A. County supervisors agree to boost minimum wage to $15 an hour by 2020," L.A. Times, July 21, 2015.

- ↑ Employment Policies Institute, "New EPI Ad Campaign Highlights Consequences of $10.10 Wage Hike Ahead of Senate Vote," organization website, April 29, 2014.

- ↑ Employment Policies Institute, Heard about all those economists who support raising the minimum wage?, New York Times full-page ad, February 27, 2014.

- ↑ Peter Coy, Pssst: Some Economists Favoring $10.10 an Hour Are Marxists, BusinessWeek, February 27, 2014.

- ↑ Jennifer Liberto, "Big business hits back on minimum wage," CNNMoney, February 21, 2014.

- ↑ Terry Gross, A Closer Look At How Corporations Influence Congress, National Public Radio, February 13, 2014.

- ↑ Peaceful Times. Local smoking bans backfire, hurt restaurants R.J. Reynolds. July 15, 1994. Bates No. 511413918/3923

- ↑ Our Presentation is About: A A Philip Morris internal presentation; January 1997. Bates No. 2070258088/8114

- ↑ Employment Policies Institute Foundation, "Return of Organization Exempt from Income Tax", 2005, Statement 14.

- ↑ 15.0 15.1 15.2 Employment Policies Institute, 2019 IRS Form 990, organizational tax filing, November 11, 2020.

- ↑ Employment Policies Institute, 2018 IRS Form 990, organizational tax filing, November 8, 2019.

- ↑ Employment Policies Institute, 2017 IRS Form 990, organizational tax filing, November 8, 2018.

- ↑ 18.0 18.1 Employment Policies Institute, 2016 IRS Form 990, organizational tax filing, November 15, 2017.

- ↑ Employment Policies Institute, 2014 IRS Form 990, organizational tax filing, November 11, 2015.

- ↑ Employment Policies Institute, "2013 IRS Form 990," organizational tax filing, November 20, 2014.

- ↑ Employment Policies Institute, "2012 IRS Form 990," organizational tax filing, November 21, 2013.

- ↑ Employment Policy Institute, 2011 Form 990, company document on file with IRS, accessed April 11, 2013

- ↑ Employment Policy Institute, 2010 Form 990, company document on file with IRS, accessed April 11, 2013

- ↑ Employment Policies Institute Foundation, "Return of Organization Exempt from Income Tax", 2005, Statement 2.

- ↑ Employment Policies Institute Foundation, "Return of Organization Exempt from Income Tax", 2005, Statement 4.

- ↑ http://www.madison.com/tct/opinion/letter/269278

- ↑ http://dispatch.com/live/content/editorials/stories/2008/02/05/Kreutzer_ART_02-05-08_A8_9697TN1.html?sid=101