Portal:Fix the Debt/Performance Pay

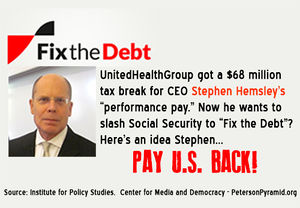

The Institute for Policy Studies has just put out a new report that shows that taxpayers are subsidizing the outlandish salaries of Fix the Debt CEOs – the same CEOs that are pushing for cuts to Medicare and Social Security to achieve a “grand bargain” on austerity.

Below we include excerpts from the IPS report, "Fix the Debt CEO's Enjoy Taxpayer Subsidized Pay," which can be read in full here.

Thanks to a “performance pay” tax loophole, large corporations in the United States today are routinely deducting enormous executive payouts from their income taxes. In effect, these companies are exploiting the U.S. tax code to send taxpayers the bill for the huge rewards they’re doling out to their top executives.

- During the three-year period 2009-2011, the 90 publicly held corporate members of the austerity-focused “Fix the Debt” lobby group shoveled out $6.3 billion in pay to their CEOs and next three highest-paid executives.

- These 90 Fix the Debt member firms raked in at least $953 million — and as much as $1.6 billion — from the “performance pay” loophole between 2009-2011.

Big Winners in the Performance Pay Racket

- Health insurance giant UnitedHealth Group enjoyed the biggest taxpayer subsidy for its CEO pay largesse. The nation’s largest HMO paid CEO Stephen Hemsley $199 million in total compensation between 2009 and 2011. Of this, at least $194 million went for fully deductible “performance pay.” That works out to a $68 million taxpayer subsidy to UnitedHealth Group – just for one individual CEO’s pay.

- Discovery Communications stood next in line for a government handout. Between 2009 and 2011, CEO David Zaslav pocketed $114 million, $105 million of this in exercised stock options and other fully deductible “performance pay.” That translates into a $37 million taxpayer subsidy for Discovery and its lavish executive pay policies. In 2012, Zaslav hauled in enough additional “performance pay” to generate a tax break worth $9 million.