SPN Funding

|

Learn more about how the State Policy Network aids ALEC and spins disinformation in the states. |

|

Learn more about corporations VOTING to rewrite our laws. |

SPN Funding is a breakout article from the main article on the State Policy Network (SPN). Please see the State Policy Network for more.

While it has become an $83 million dollar right-wing empire, SPN and most of its affiliates do not post their major donors on their websites. But public documents discovered by the Center for Media and Democracy (CMD) reveal that SPN is largely funded by global corporations -- such as Reynolds American, Altria, Microsoft, AT&T, Verizon, GlaxoSmithKline, Kraft Foods, Express Scripts, Comcast, Time Warner, and the Koch- and Tea Party-connected DCI Group lobbying and PR firm -- that stand to benefit from SPN's agenda, as well as out-of-state special interests like the billionaire Koch brothers, the Waltons, the Bradley Foundation, the Roe Foundation of SPN's founder, and the Coors family -- who are underwriting an extreme legislative agenda that undermines the rights of Americans. Corporations like Facebook and the for-profit online education company K12 Inc., as well as the e-cigarette company NJOY (a new member of the American Legislative Exchange Council (ALEC)), also fund SPN, as demonstrated by its most recent annual meeting.

A set of coordinated fundraising proposals obtained and released by The Guardian in early December 2013 confirm many of these SPN members' intent to change state laws and policies, referring to "advancing model legislation" and "candidate briefings." These activities "arguably cross the line into lobbying," The Guardian notes.[1] The funding proposals are from 40 SPN members to the Searle Freedom Trust, a private foundation that funds right-wing groups such as Americans for Prosperity, ALEC, Americans for Tax Reform, and more. It is the family foundation funded by the "NutraSweet" fortune of G.D. Searle & Company, which was purchased by Monsanto in 1985 and which is now part of Pfizer. The documents were submitted to Stephen Moore, Wall Street Journal editorial board member, founder of the Club for Growth, and ALEC "scholar," who was asked to review the proposals and "identify your top 20 and bottom 20 proposals."

Below is analysis of how SPN and its member think tanks are funded:

Contents

Funding

The revenue of SPN itself (separate from its member groups) increased by over 26 times from 2001 to 2016 (from $391,496 in 2001 to $10,345,444 in 2016)[2][3][4]

While, in 2007, the approximately $40 million in combined revenues of the 52 member think tanks in 45 states that were then members was less than the Heritage Foundation's budget that year of $50 million, SPN president Tracie Sharp announced in late 2007 a plan to expand think-tank revenues by $50 million by 2012.[5] In 2010, combined revenues of SPN itself and it's (then) 59 member state think tanks was $76.1 million, according to a review of the groups' IRS forms 990 by the Center for Media and Democracy (CMD). See 2010 below for more.

SPN has grown into a multi-million dollar “think tank” empire, as SPN and its member think tanks cumulatively reported over $83.2 million in revenue and $78.9 million in expenses in 2011. SPN itself saw an increase in revenue of more than $3 million from 2011 to 2012 (see below). Where is all that money coming from?

The 26th Annual SPN Meeting was funded by the following organizations. According to the SPN site, organizations needed to donate between $5,000 and $50,000 to be a part of this list:

- Sutherland Institute

- 1st Amendment Partnership

- AC Fitzgerald

- America's Future Foundation

- American Fuel and Petrochemical Manufacturers

- American Philanthropic

- Americans for Prosperity

- Atlas Network

- Becket Religious Liberty for All

- Charles Koch Institute

- The Center for Growth for and Opportunity at Utah State University

- ClearWord Communications Group

- Competitive Enterprise Institute

- Conservative Leaders for Education

- EdChoice

- Donors Trust

- Emergent Order

- Epipheo

- Foundation for Economic Education

- The Heritage Foundation

- Hillsdale College

- Institute for Humane Studies

- Institute for Justice

- k12

- Libertas

- Lincoln

- Loving Liberty

- Mercatus Center

- NCTA

- Pacific Legal Foundation

- PERC

- Pfizer

- The Policy Circle

- Reason Foundation

- Tax Foundation

- Think Freely Media

- Thomas Jefferson Institute

- The Zoldak Agency

A public document listing SPN's 2010 funders includes the following top and key funders (bolded funders have also funded ALEC):[6]

- Giving $1.5 million or more:

- Giving $250,000 to $600,000:

- DonorsTrust Inc.

- Northern Trust Charitable Giving Program (a donor-advised fund)

- BMO Harris Bank

- Giving $100,000 to $249,000:

- Jaquelin Hume Foundation

- Karen Wright (member of the Kochs’ million-dollar donor club and American Petroleum Institute boardmember)

- Giving $25,000 to $99,000:

- Famsea Corporation

- RAI Services Company (Reynolds American Inc.)

- Altria Client Services Inc.

- Microsoft

- AT&T

- GlaxoSmithKline

- White Hat Ventures, LLC

- Giving $5,000 to $24,000:

- Kraft Foods

- Atlantic Trust Company

- Philip Morris

- Reynolds American

- Express Scripts

- American Legislative Exchange Council

- DCI Group, LLC (top Republican lobby and PR firm with ties to the Koch brothers, the tobacco industry, the Tea Party, and billionaire Pete Peterson’s “Campaign to Fix the Debt”)

- Verizon Communications, Inc.

- Comcast

- Olive Hill, LLC

- Time Warner Cable Shared Service Center

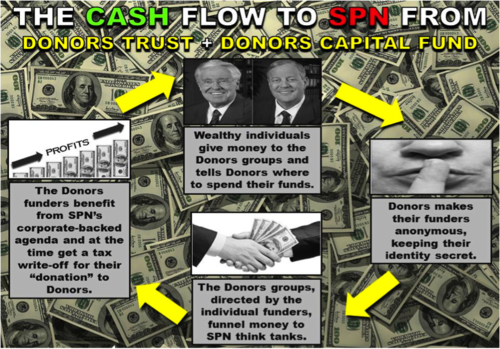

Although there is no direct funding from Koch Industries or any of the Koch family foundations in that 2010 document, both Donors funds are connected to the Kochs and operate to conceal the identity of the donor.

In addition, the following corporations, front groups, and various non-profit organizations sponsored SPN’s most recent annual meeting in Oklahoma City on September 24 - 27, 2013, for undisclosed amounts (bolded funders have also funded ALEC):[7]

- Express Scripts

- Vernon K. Krieble Foundation

- The Roe Foundation

- Alliance for School Choice

- Atlas Network

- RAI Services Company

- The Liberty Foundation

- Voter Gravity

- Altria

- NJOY (electronic cigarettes)

- Charles Koch Institute

- National School Choice Week

- Quick Reliable Printing (QRP)

- R Street

- Taxpayers United of America

- eResources

- How Money Walks

- Spark Freedom

- Franklin Center for Government and Public Integrity

- Jones Public Relations

- National Cable & Telecommunications Association

- Reason Foundation

- Consumer Healthcare Products Association

- American Legislative Exchange Council

- The Carleson Center Welfare Reform Action Fund

- Stephen Clouse and Associates

- Comcast

- A.C. Fitzgerald & Associates

- ClearWord Communications Group, Inc. (donor strategies firm)

- Time Warner Cable

- K12 Inc.

- Competitive Enterprise Institute

- Frontiers of Freedom

- Ceterus (virtual office company)

- Case Consulting Services

- DonorsTrust

- The Heritage Foundation

- National Center for Policy Analysis (NCPA)

- Students for Liberty

- Right on Crime

- Tax Foundation

- ROC Exposed (an anti-labor front group run by Berman & Co.)

- Microsoft

- Mercatus Center at George Mason University

- Mackinac Center for Public Policy

- Americans for Tax Reform

- The Independent Institute

- Americans for Prosperity Foundation

- MP Plumbing Co.

- American Enterprise Institute

- Campaign Marketing Strategies

- U.S. Chamber of Commerce Global Intellectual Property Center

- Generation Opportunity (a Koch-financed group focusing on young voters)

- American Philanthropic

- Young Americans for Liberty

The State Policy Network has also received funding from the Claude R. Lambe Foundation (a Koch Family Foundation),[8] the Olin Foundation, the Richard and Helen DeVos Foundation, the Bradley Foundation, the Castle Rock Foundation (Coors affiliated),[9] the Adolph Coors Foundation, the McCamish Foundation, the JM Foundation, the Smith Richardson Foundation, and the Roe Foundation, among others.[10]

SPN's Cozy Relationship with Big Tobacco

SPN has close ties with the tobacco industry. SPN, its member think tanks, and SPN related-entities such as ALEC, the Heritage Foundation, and the Cato Institute, have received significant funding from the tobacco industry that has continued through at least 2012, according to industry documents.[11] The Nation journalist Lee Fang previously reported that SPN relied on funding from the tobacco industry throughout the 1990s, and in return assisted the tobacco industry "in packaging its resistance to tobacco taxes and health regulations as part of a ‘freedom agenda’ for conservatives."[12]

During SPN President Tracie Sharp’s tenure at the Cascade Policy Institute, Philip Morris state lobbyists worked hand-in-hand with CPI to oppose tobacco taxes.[12]

In 2001, Philip Morris Director of External Affairs Joshua Slavitt told an SPN conference that the best way to "positively impact your relationship with prospectively and current corporate contributors" was to "understand their priorities" and to make "contribution requests to suit the needs of your supporters."[13]

It appears that SPN and its member think tanks were listening, as cash from Big Tobacco to SPN continues to flow. In 2012, Altria (formerly Philip Morris) listed SPN and 21 member think tanks as recipients of corporate “charitable” contributions (which it calls “business directed giving”), although the corporation does not disclose the amount of the contributions.[11] The Center for Media and Democracy has discovered that Altria/Philip Morris and Reynolds American contributed a total of $105,000 to SPN alone in 2010.[6] Industry documents made publicly available by the 1998 Master Tobacco Agreement between the Attorney Generals of 46 states and the nation's five major tobacco companies and two tobacco industry associations show that SPN think tanks have been recipients of funding from Big Tobacco dating back to the early 1990s.[14]

In turn, many SPN think tanks often advocate against raising tobacco and excise taxes and work to defeat smoking bans. In Ohio, for example, the Buckeye Institute (which has received at least $60,000 in direct funding from the tobacco industry over the years, including funding from Altria as recently as 2012)[15] has published numerous reports and articles against tobacco taxes,[16] and the 1851 Center for Constitutional Law, formerly an offshoot litigation center of the Buckeye Institute,[17] has led legal efforts against Ohio's public smoking ban.[18]

SPN Funders: Koch, Bradley, Roe, Coors, Etc.

SPN has received funding from one of the Koch brothers' Koch Family Foundations, the Claude R. Lambe Foundation, in 2002,[19] 2003,[20] 2005,[21] and 2006.[22]

In 2010, foundation funders of SPN itself included, but were not limited to, the Lynde and Harry Bradley Foundation,[23] the Jaquelin Hume Foundation,[24] the Chicago Community Foundation,[25] DonorsTrust and Donors Capital Fund (large donor-directed funds with right-wing ideology; see below for more),[26] the Vanguard Charitable Endowment Program (a donor-directed fund like DonorsTrust, although smaller; see below for more),[27] the Gleason Family Foundation,[28] the Searle Freedom Trust,[29] the Armstrong Foundation,[30] the JM Foundation,[31] the Roe Foundation,[32] the Lovett and Ruth Peters Foundation INC,[33] the John William Pope Foundation,[34] the Lowndes Foundation,[35] the GFC Foundation,[36] the Chase Foundation of Virginia,[37] the Rothschild Art Foundation,[38] the Jewish Communal Fund (a donor-advised fund),[39] the Silverwing Foundation,[40] the A.P. Kirby, Jr. Foundation,[41] the Anna Paulina Foundation,[42] and the JP Humphreys Foundation Inc.,[43] according to analysis of IRS forms 990 and foundation donation information by the Center for Media and Democracy (CMD).

At the time of SPN's first annual meeting in August 1992, it was funded by the Adolph Coors Foundation, the McCamish Foundation of Atlanta, Georgia, the JM and Smith Richardson foundations in New York City, and the Roe Foundation of Greenville, South Carolina.[10]

Koch Money

SPN think tanks do not as a general rule publicly disclose their donors. But CMD has discovered that David Koch gave $125,000 directly to the Massachusetts-based SPN member think tank Pioneer Institute for Public Policy Research in 2007, making him the largest donor that year. A list of 2007 funders that was disclosed to the IRS was inadvertently made public. That list of funders -- featuring Pennsylvania-based Sovereign Bank, oil and gas magnate Lovett C. Peters, banker William Edgerly, retired Blue Seal Feeds CEO Dean Webster (former director of the right-wing think tank Capital Research Center), Mitt Romney's lieutenant governor Kerry Healey, and textile heir Roger Milliken in addition to David Koch -- provides an important case study in how SPN's member think tanks are funded, and by whom.[44]

Similarly, in 2012, a list of 2010 funders of an SPN member think tank in Texas, the Texas Public Policy Foundation (TPPF), that was disclosed to the IRS was inadvertently made public. It reveals that Koch Industries gave $159,834 directly to TPPF, in addition to $69,788.61 from the Claude R. Lambe Foundation, which is a Koch family foundation.

If David Koch gave this much money to one state think tank in 2007, and the Kochs’ corporation gave another chunk of money to another state think tank in 2010, it begs the question of what other non-profit organizations the Koch brothers and their corporation fund directly in any given year.[45]

Mystery Funds

In the same accidentally disclosed 2010 list of TPPF funders, it is revealed that SPN itself gave TPPF $49,306.90 in 2010 (SPN's own tax filings claim that it only gave TPPF $19,500 in 2010),[46] but what's more, Tracie Sharp, SPN's executive director, was the contact person for an additional $495,000. These two grants, for $300,000 and $195,000, were listed as being received from the "State Think Tank Fund" and the "Government Transparency Fund," respectively -- two funds about which virtually nothing is known.[45]

SPN’s leader apparently has at her disposal two funds of such significant value that she can readily use them to dispense nearly one-half of a million dollars to one think tank in Texas in one single year. It is not known how much Sharp dispensed, if anything, to other SPN think tanks that year or over many years. It is not known who or what is the source of such money that she controls but that is apparently not controlled by SPN itself. And it is not known what these untold sums have purchased or been used to accomplish.

Funding from Secret Donors

SPN received $10 million between 2007 and 2012 from two closely related funds -- Donors Trust (DT) and Donors Capital Fund (DCF) -- that are spin-offs of the Philanthropy Roundtable run by SPN board member Whitney L. Ball.[47] They are what are called "donor-advised funds," which means that the fund creates separate accounts for individual donors, and the donors then recommend disbursements from the accounts to different non-profits. It cloaks the identity of the original mystery donors because the funds are then distributed in the name of DT or DCF. What's more, the two funds exist for "donors dedicated to the ideals of limited government, personal responsibility, and free enterprise[,] . . . always with the goal of advancing the philosophy they share with their donors." For example, a relatively unknown Koch family foundation called the Knowledge and Progress Fund gave $4.5 million to Donors Trust between 2007 and 2010, but what organizations received that funding from Donors is unknown.[48] In addition, this cloaked money has gone to at least 51 of SPN's member think tanks between 2007 and 2011, according to the Center for Public Integrity. That includes "[t]en state-level think tanks[, which] got a total of $200,000 from Donors Trust to attend ALEC meetings in 2011[,] including the Michigan-based Mackinac Center and the Arizona-based Goldwater Institute, which introduced a raft of anti-union model bills at ALEC's spring 2012 conference."[47]

A review of funding from the Donors groups to SPN and its member think tanks reveals that the two Donors groups funneled nearly $50 million to SPN and 55 member think tanks in just the four years between 2008 and 2011.[49]

This money was specifically itemized by Donors to be used for participation in ALEC, so-called journalism programs and statehouse reporting operations, transparency projects, direct mail efforts, litigation centers, or reports against Affordable Care Act and environmental protections.[50]

According to DCF's 2011 IRS disclosure, it funded Michigan's Mackinac Center, North Carolina's John Locke Foundation, the Texas Public Policy Foundation, Pennsylvania's Commonwealth Foundation, and six other member think tanks "for participation at American Legislative Exchange Council meeting," providing a total of $200,000 to the groups for that purpose.[51] From 2008 to 2012, DonorsTrust and Donors Capital Fund have funded at least 51 SPN member groups in almost every state, including giving start-up funds for new franchises in Arkansas, Rhode Island, and Florida, according to the Center for Public Integrity, a nonprofit investigative news organization.[52]

Between 2002 and 2010, according to DeSmog Blog, DT and DCF gave the following amounts to SPN member state think tanks:[53]

- $2.4 million to the South Carolina Policy Council,

- $2.3 million to the Mackinac Center for Public Policy,

- $1.8 million to Arizona's Goldwater Institute,

- $1.8 million to the Maine Heritage Policy Center,

- $1.7 million to the Yankee Institute for Public Policy,

- $1.5 million to the Tennessee Center for Policy Research,

- $1.4 million to the Illinois Policy Institute,

- $1.3 million to the Independence Institute,

- $1.2 million to Washington State's Evergreen Freedom Foundation,

- $1.2 million to the Commonwealth Foundation for Public Policy,

- $1.2 million to the Pacific Research Institute for Public Policy,

- $1.2 million to the Nevada Policy Research Institute,

- $1.1 million to the Sutherland Institute,

- $1.1 million to the Buckeye Institute for Public Policy Solutions,

- $1 million to the Cascade Policy Institute,

- $1 million to New York State's Manhattan Institute (SPN member the Empire Center for New York State Policy is a project of the Manhattan Institute),

- $932,000 to the Grassroot Institute of Hawaii,

- $902,000 to the Montana Policy Institute, and

- $764,000 to the James Madison Institute for Public Policy;

and to SPN associate members:[53]

- $13.5 million to the Heartland Institute,

- $11.3 million to the Americans for Prosperity Foundation,

- $8.2 million to the Sam Adams Alliance,

- $6.6 million to Americans for Limited Government,

- $3 million to the Independent Women's Forum,

- $2.8 million to the Foundation for Individual Rights in Education,

- $2.8 million to the Center for Competitive Politics,

- $2.4 million to the Institute for Humane Studies and George Mason University,

- $2.3 million to the Franklin Center for Government and Public Integrity,

- $2 million to Citizens Against Government Waste,

- $2 million to the Acton Institute for Study of Religion & Liberty,

- $1.8 million to the Mercatus Center,

- $1.4 million to the American Council of Trustees and Alumni,

- $1.4 million to the Cato Institute,

- $1.3 million to the Citizens in Charge Foundation,

- $1 million to the Institute for Justice,

- $825,000 to Young America's Foundation,

- $815,000 to the National Tax Limitation Committee,

- $802,000 to the National Right to Work Legal Defense Foundation, and

- $738,000 to the National Taxpayers Union Foundation.

Funders of SPN's individual member think tanks may be found in the articles on each think tank, linked from the article on SPN Members. Please see SPN Members for more.

Not only do the Donors groups themselves fund SPN and its members, but through a network of shared board and staff members, there is a larger group of Donors-related foundations funding SPN. Searle Freedom Trust, for example, whose president and CEO Kimberly Dennis is the chairman of the board of DonorsTrust and the secretary of the board of Donors Capital Fund, gave $2,155,000 to SPN itself from 2004 to 2011, $1.31 million to California’s Pacific Research Institute from 2003 to 2011, $295,000 to the Texas Public Policy Foundation from 2007 to 2011, $275,000 to Arizona’s Goldwater Institute from 2007-2011, $121,500 to Ohio’s Buckeye Institute for Public Policy Solutions in 2009, and $30,000 to Oregon’s Cascade Policy Institute in 2004 (it also gave DonorsTrust $2.3 million from 2001 to 2011 and $150,000 to Donors Capital Fund in 2001).[54] The William E. Simon Foundation, whose president James Piereson is DonorsTrust’s vice chairman, gave $759,250 to California’s Pacific Research Institute from 2002 to 2011 and $2,500 to Arizona’s Goldwater Institute in 2007 (it also gave DonorsTrust $895,000 from 2003 to 2011).[55]

Revenue and Expenses

2016

Below is information from SPN's 2015 IRS Form 990:[56]

Revenue: $10,345,444

Expenses: $10,426,065

Net Assets: $4,495,089

2015

Below is information from SPN's 2015 IRS Form 990:[57]

Revenue: $9,480,183

Expenses: $8,794,478

Net Assets: $4,679,359

2014

Below is information from SPN's 2014 IRS Form 990:[58]

Revenue: $8,055,213

Expenses: $7,625,250

Net Assets: $4,056,476

2013

Below is information from SPN's 2013 IRS Form 990:[59]

Revenue: $8,050,050 Expenses: $8,471,560 Net Assets: $3,214,795

2012

Below is information from SPN's 2012 IRS Form 990:[60]

Revenue: $8,050,050

Expenses: $8,471,560

Net Assets: $3,214,795

2011

Below is information from SPN's 2011 IRS Form 990:[61]

Revenue: $5,160,138

Expenses: $5,031,961

Net Assets: $3,641,643

However, combined incomplete revenues of SPN itself along with its (then) 59 member state think tanks was $83.2 million, according to a review of the groups' IRS forms 990 by the Center for Media and Democracy (CMD) in November 2013. See the chart below for more. When combined with the revenue of Heartland Institute, an SPN associate member that also focuses largely on state issues, the combined revenue in 2011 was $87.8 million.

| State | Think Tank | 2011 Total Revenue | 2011 Total Expenses | 2011 Net Assets |

|---|---|---|---|---|

| NATIONAL | State Policy Network | $5,160,138 | $5,031,961 | $3,641,643 |

| Alabama | Alabama Policy Institute | $1,148,661 | $1,219,046 | $506,497 |

| Alaska | Alaska Policy Forum | $57,664 | $102,715 | $120,042 |

| Arizona | Goldwater Institute | $4,190,522 | $3,764,908 | $4,795,651 |

| Arkansas | Advance Arkansas Institute | $195,410 | $117,685 | $77,725 |

| Arkansas | Arkansas Policy Foundation | $125,157 | $123,862 | $2,487 |

| California | Pacific Research Institute | $4,706,288 | $4,904,662 | $3,450,596 |

| Colorado | Independence Institute | $1,718,687 | $1,845,951 | $4,702,527 |

| Connecticut | Yankee Institute for Public Policy | $495,526 | $545,081 | $173,980 |

| Delaware | Caesar Rodney Institute | $145,592 | $228,098 | $17,054 |

| Florida | Foundation for Government Accountability | $212,194 | $151,739 | $60,455 |

| Florida | James Madison Institute | $1,966,419 | $1,297,246 | $1,758,565 |

| Georgia | Georgia Public Policy Foundation | $660,671 | $571,124 | $138,779 |

| Hawaii | Grassroot Institute of Hawaii | $189,566 | $394,440 | $30,766 |

| Idaho | Idaho Freedom Foundation | $355,673 | $350,348 | $294,580 |

| Illinois | Illinois Policy Institute | $2,875,519 | $2,643,618 | $408,532 |

| Indiana | Indiana Policy Review Foundation | $136,520 | $134,446 | $9,663 |

| Iowa | Public Interest Institute | -$90,340 | $465,209 | $6,101,339 |

| Kansas | Kansas Policy Institute | $608,340 | $598,576 | $193,545 |

| Kentucky | Bluegrass Institute for Public Policy Solutions | $329,547 | $466,950 | $77,751 |

| Louisiana | Pelican Institute for Public Policy | $428,000 | $509,574 | $8,626 |

| Maine | Maine Heritage Policy Center | $716,761 | $855,821 | $77,883 |

| Maryland | Calvert Institute for Policy Research | |||

| Maryland | Free State Foundation | $666,039 | $491,034 | $1,007,425 |

| Maryland | Maryland Public Policy Institute | $323,314 | $409,051 | $196,326 |

| Massachusetts | Pioneer Institute | $2,204,323 | $1,616,241 | $2,628,329 |

| Michigan | Mackinac Center for Public Policy | $5,778,257 | $3,925,505 | $9,523,575 |

| Minnesota | Center of the American Experiment | $799,736 | $770,575 | $6,327 |

| Minnesota | Freedom Foundation of Minnesota | $418,957 | $420,735 | $4,154 |

| Mississippi | Mississippi Center for Public Policy | $709,890 | $723,635 | $343,565 |

| Missouri | Show-Me Institute | $1,434,730 | $1,383,822 | $468,189 |

| Montana | Montana Policy Institute | $251,487 | $436,855 | $84,291 |

| Nebraska | Platte Institute for Economic Research | $394,830 | $422,697 | $105,667 |

| Nevada | Nevada Policy Research Institute | $603,803 | $791,558 | $872,043 |

| New Hampshire | Josiah Bartlett Center for Public Policy | $247,808 | $301,301 | $34,217 |

| New Jersey | Common Sense Institute | $193,023 | $218,157 | $106,758 |

| New Jersey | Solutions for New Jersey | $5,000 | $15,134 | $197 |

| New Mexico | Rio Grande Foundation | $363,912 | $342,854 | $66,509 |

| New York | Empire Center for New York State Policy (project of the Manhattan Institute for Policy Research) | $14,873,971 | $13,417,313 | $14,754,647 |

| North Carolina | John Locke Foundation | $3,446,927 | $3,401,906 | $600,823 |

| North Carolina | John William Pope Civitas Institute | $1,583,410 | $1,489,622 | $474,655 |

| North Dakota | North Dakota Policy Council | |||

| Ohio | Buckeye Institute for Public Policy Solutions | $491,340 | $623,952 | $224,511 |

| Oklahoma | Oklahoma Council of Public Affairs | $3,060,027 | $1,806,961 | $3,456,211 |

| Oregon | Cascade Policy Institute | $943,525 | $984,233 | $442,438 |

| Pennsylvania | Commonwealth Foundation | $1,951,566 | $1,671,566 | $709,983 |

| Rhode Island | Ocean State Policy Research Institute | $218,854 | $77,867 | $140,987 |

| South Carolina | South Carolina Policy Council | $1,014,882 | $1,197,673 | $607,216 |

| South Dakota | Great Plains Public Policy Institute | |||

| Tennessee | Beacon Center of Tennessee | $527,219 | $536,835 | $279,211 |

| Texas | Texas Conservative Coalition Research Institute | $705,481 | $915,387 | $398,747 |

| Texas | Texas Public Policy Foundation | $5,756,074 | $4,948,598 | $4,235,880 |

| Utah | Sutherland Institute | $1,309,705 | $1,511,379 | $144,874 |

| Vermont | Ethan Allen Institute | $173,781 | $113,223 | $93,805 |

| Virginia | Thomas Jefferson Institute | $259,018 | $277,803 | $32,094 |

| Virginia | Virginia Institute for Public Policy | $126,638 | $138,274 | $82,385 |

| Washington | Freedom Foundation of Washington | $2,148,032 | $2,908,106 | $502,865 |

| Washington | Washington Policy Center | $1,513,481 | $1,860,653 | $1,810,517 |

| West Virginia | Public Policy Foundation of West Virginia | $51,501 | $36,942 | $17,679 |

| Wisconsin | MacIver Institute for Public Policy | $632,359 | $504,410 | $406,404 |

| Wisconsin | Wisconsin Policy Research Institute | $695,036 | $942,350 | $2,146,242 |

| Wyoming | Wyoming Liberty Group | $1,043,750 | $973,058 | $12,783 |

| TOTAL | SPN + 59 | $83,254,201 | $78,930,325 | $73,671,215 |

(Data is based on organizations' IRS tax filing years, which may or may not correspond to calendar years.)

2010

Below is information from SPN's 2010 IRS Form 990:[62]

Revenue

Primary Revenue: $4,749,695

Other Revenue: $62,818

Total Revenue: $4,812,513

Expenses

Program Expenses: $766,175

Administrative Expenses: $863,178

Fundraising Expenses: $920,056

Total Functional Expenses: $3,941,133

Net Assets: $3,534,009

However, combined revenues of SPN itself along with its (then) 59 member state think tanks was $76.1 million, according to a review of the groups' IRS forms 990 by the Center for Media and Democracy (CMD). See the chart below for more. When combined with the revenue of Heartland Institute, an SPN associate member that also focuses largely on state issues, the combined revenue in 2010 was $82.2 million.

| State | Think Tank | 2010 Total Revenue | 2010 Total Expenses | 2010 Net Assets |

|---|---|---|---|---|

| NATIONAL | State Policy Network | $4,812,513 | $3,941,113 | $3,534,009 |

| Alabama | Alabama Policy Institute | $1,100,517 | $1,110,437 | $576,881 |

| Alaska | Alaska Policy Forum | $291,683 | $126,590 | |

| Arizona | Goldwater Institute | $3,299,424 | $3,506,634 | $4,380,969 |

| Arkansas | Arkansas Policy Foundation | $112,608 | $113,327 | $1,192 |

| California | Pacific Research Institute | $3,923,123 | $5,257,310 | $3,601,719 |

| Colorado | Independence Institute | $1,965,509 | $1,963,635 | $2,417,013 |

| Connecticut | Yankee Institute for Public Policy | $582,392 | $534,620 | $222,535 |

| Delaware | Caesar Rodney Institute | $319,768 | $275,875 | $99,560 |

| Florida | James Madison Institute | $1,785,368 | $1,107,183* | $1,089,392 |

| Georgia | Georgia Public Policy Foundation | $570,780 | $611,182 | $47,357 |

| Hawaii | Grassroot Institute of Hawaii | $519,209 | $495,469 | $235,640 |

| Idaho | Idaho Freedom Foundation | $494,134 | $356,081 | $289,255 |

| Illinois | Illinois Policy Institute | $1,791,057 | $1,732,183 | $176,631 |

| Indiana | Indiana Policy Review Foundation | $114,700 | $147,629 | $7,589 |

| Iowa | Public Interest Institute | $1,119,463 | $510,401 | $7,198,734 |

| Kansas | Kansas Policy Institute | $687,796 | $683,675 | $183,781 |

| Kentucky | Bluegrass Institute for Public Policy Solutions | $400,403 | $374,062 | $212,718** |

| Louisiana | Pelican Institute for Public Policy | $435,450 | $371,682 | $90,200 |

| Maine | Maine Heritage Policy Center | $1,071,606 | $1,153,631 | $216,943 |

| Maryland | Calvert Institute for Policy Research | |||

| Maryland | Free State Foundation | $489,458 | $347,033 | $832,420 |

| Maryland | Maryland Public Policy Institute | $390,118 | $372,190 | $282,063 |

| Massachusetts | Pioneer Institute | $1,255,039 | $1,475,754 | $2,040,246 |

| Michigan | Mackinac Center for Public Policy | $3,511,159 | $3,401,252 | $7,581,106 |

| Minnesota | Center of the American Experiment | $711,473 | $651,873 | -$22,834 |

| Minnesota | Freedom Foundation of Minnesota | $280,704 | $468,104* | $5,932 |

| Mississippi | Mississippi Center for Public Policy | $585,755 | $726,949 | $352,938 |

| Missouri | Show-Me Institute | $1,695,988 | $1,574,040 | $417,281 |

| Montana | Montana Policy Institute | $593,452 | $428,425 | $269,659 |

| Nebraska | Platte Institute for Economic Research | $564,483 | $464,873 | $133,534 |

| Nevada | Nevada Policy Research Institute | $776,450 | $654,447 | $1,072,828 |

| New Hampshire | Josiah Bartlett Center for Public Policy | $228,770 | $241,723 | $87,642 |

| New Jersey | Common Sense Institute | $275,020 | $147,351 | $131,894 |

| New Jersey | Solutions for New Jersey | $54,227 | $47,786 | $6,121 |

| New Mexico | Rio Grande Foundation | $450,785 | $421,834 | $45,451 |

| New York | Empire Center for New York State Policy (project of the Manhattan Institute for Policy Research) | $11,509,408 | $12,415,804 | $12,112,938 |

| North Carolina | John Locke Foundation | $3,898,632 | $3,644,714 | $555,648 |

| North Carolina | John William Pope Civitas Institute | $1,384,584 | $1,599,000 | $255,763 |

| North Dakota | North Dakota Policy Council | |||

| Ohio | Buckeye Institute for Public Policy Solutions | $819,385 | $531,271 | $357,122 |

| Oklahoma | Oklahoma Council of Public Affairs | $1,385,424 | $1,412,168 | $2,205,719 |

| Oregon | Cascade Policy Institute | $988,404 | $976,227 | $483,146 |

| Pennsylvania | Commonwealth Foundation | $1,369,386 | $1,247,489 | $429,983 |

| Rhode Island | Ocean State Policy Research Institute | $253,975 | $127,692 | $141,770 |

| South Carolina | South Carolina Policy Council | $1,248,397 | $1,391,461 | $790,007 |

| South Dakota | Great Plains Public Policy Institute | |||

| Tennessee | Beacon Center of Tennessee | $608,125 | $360,582 | $283,244 |

| Texas | Texas Conservative Coalition Research Institute | $867,632 | $595,976 | $608,653** |

| Texas | Texas Public Policy Foundation | $4,674,836 | $3,390,188 | $3,428,404 |

| Utah | Sutherland Institute | $1,453,952 | $1,321,873 | $346,548 |

| Vermont | Ethan Allen Institute | $160,370 | $180,953 | $63,247 |

| Virginia | Thomas Jefferson Institute | $306,376 | $298,312 | $50,869 |

| Virginia | Virginia Institute for Public Policy | $210,020 | $204,821 | $51,932 |

| Washington | Freedom Foundation of Washington | $2,680,800 | $2,676,198 | $1,262,939 |

| Washington | Washington Policy Center | $1,500,932 | $1,889,632 | $2,203,342 |

| West Virginia | Public Policy Foundation of West Virginia | $35,011 | $49,413 | $3,120 |

| Wisconsin | MacIver Institute for Public Policy | $404,334 | $496,830 | $278,455 |

| Wisconsin | Wisconsin Policy Research Institute | $1,821,093 | $1,748,844 | $2,393,556 |

| Wyoming | Wyoming Liberty Group | $1,253,526 | $1,265,513 | -$52,909 |

| TOTAL | SPN + 59 | $76,094,986 | $73,621,334 | $66,071,895 |

* Data given on 2010 and 2011 Forms 990 is contradictory. This figure is from the 2010 Form 990. ** Data given on 2010 and 2011 Forms 990 is contradictory. This figure is from the 2011 Form 990.

(Data is based on organizations' IRS tax filing years, which may or may not correspond to calendar years.)

2009

Below is information from SPN's 2009 IRS Form 990:[63]

Revenue: $4,480,054

Expenses: $3,828,346

Net Assets: $2,672,883

However, combined revenues of SPN itself along with its then-58 member state think tanks (there were 59 member state think tanks in 2010, 2011, and 2012) was $64.2 million, according to a review of the groups' IRS forms 990 by CMD. Please see the chart below for more. When combined with the revenue of Heartland Institute, an SPN associate member that also focuses largely on state issues, the combined revenue in 2009 was $71 million.

| State | Think Tank | 2009 Total Revenue | 2009 Total Expenses | 2009 Net Assets |

|---|---|---|---|---|

| NATIONAL | State Policy Network | $4,480,054 | $3,828,346 | $2,672,883 |

| Alabama | Alabama Policy Institute | $1,106,954 | $1,112,979 | $632,334 |

| Alaska | Alaska Policy Forum | $63,405 | $20,501 | $42,904 |

| Arizona | Goldwater Institute | $2,540,977 | $2,681,328 | $4,557,541 |

| Arkansas | Arkansas Policy Foundation | $132,054 | $134,857 | $1,911 |

| California | Pacific Research Institute | $4,707,728 | $4,962,507 | $4,834,041 |

| Colorado | Independence Institute | $1,469,690 | $1,527,047 | $2,403,353 |

| Connecticut | Yankee Institute for Public Policy | $465,531 | $402,778 | $174,763 |

| Delaware | Caesar Rodney Institute | $259,138 | $206,242 | $55,667 |

| Florida | James Madison Institute | $909,458 | $874,987 | $411,208 |

| Georgia | Georgia Public Policy Foundation | $583,209 | $634,818 | $87,759 |

| Hawaii | Grassroot Institute of Hawaii | $387,191 | $519,000 | $211,900 |

| Idaho | Idaho Freedom Foundation | $369,377 | $218,275 | $151,202 |

| Illinois | Illinois Policy Institute | $1,469,110 | $1,327,172 | $117,757 |

| Indiana | Indiana Policy Review Foundation | $153,231 | $159,179 | $40,519 |

| Iowa | Public Interest Institute | $1,661,139 | $530,950 | $6,589,672 |

| Kansas | Kansas Policy Institute | $601,224 | $527,245 | $179,660 |

| Kentucky | Bluegrass Institute for Public Policy Solutions | $430,686 | $422,875 | $196,526 |

| Louisiana | Pelican Institute for Public Policy | $377,978 | $215,938 | $26,432 |

| Maine | Maine Heritage Policy Center | $1,306,093 | $1,291,520 | $298,968 |

| Maryland | Calvert Institute for Policy Research | |||

| Maryland | Maryland Public Policy Institute | $376,543 | $320,252 | $264,135 |

| Massachusetts | Pioneer Institute | $1,372,090 | $1,342,630 | $1,715,824 |

| Michigan | Mackinac Center for Public Policy | $3,310,018 | $3,377,168 | $7,345,742 |

| Minnesota | Center of the American Experiment | $744,556 | $658,994 | -$82,434 |

| Minnesota | Freedom Foundation of Minnesota | $549,963 | $335,375 | $193,332 |

| Mississippi | Mississippi Center for Public Policy | $725,007 | $740,824 | $45,279 |

| Missouri | Show-Me Institute | $1,931,999 | $1,764,858 | $295,333 |

| Montana | Montana Policy Institute | $242,105 | $347,747 | $104,632 |

| Nebraska | Platte Institute for Economic Research | $441,844 | $412,490 | $33,924 |

| Nevada | Nevada Policy Research Institute | $659,931 | $631,363 | $945,002 |

| New Hampshire | Josiah Bartlett Center for Public Policy | $315,887 | $323,502 | $103,124 |

| New Jersey | Common Sense Institute | $5,000 | $775 | $4,225 |

| New Jersey | Solutions for New Jersey, Inc. | $0 | $1,080 | -$1,255 |

| New Mexico | Rio Grande Foundation | $262,253 | $442,884 | $16,500 |

| New York | Empire Center for New York State Policy (project of the Manhattan Institute for Policy Research Inc.) | $6,128,425 | $8,352,484 | $13,162,062 |

| North Carolina | John Locke Foundation | $3,624,086 | $3,549,208 | $301,730 |

| North Carolina | John William Pope Civitas Institute | $1,066,592 | $1,551,161 | $457,628 |

| North Dakota | North Dakota Policy Council | $209,833 | $239,089 | $68,764 |

| Ohio | Buckeye Institute for Public Policy Solutions | $878,745 | $655,685 | $69,008 |

| Oklahoma | Oklahoma Council of Public Affairs | $1,062,784 | $1,064,986 | $2,217,243 |

| Oregon | Cascade Policy Institute | $912,019 | $981,683 | $470,969 |

| Pennsylvania | Commonwealth Foundation | $1,032,887 | $1,125,595 | $308,086 |

| Rhode Island | Ocean State Policy Research Institute | $243,599 | $243,140 | $15,487 |

| South Carolina | South Carolina Policy Council | $1,426,970 | $1,257,078 | $933,071 |

| South Dakota | Great Plains Public Policy Institute | |||

| Tennessee | Tennessee Center for Policy Research | $463,320 | $583,135 | $35,701 |

| Texas | Texas Public Policy Foundation | $3,223,804 | $3,026,663 | $2,143,756 |

| Utah | Sutherland Institute | $1,335,989 | $1,273,550 | $214,469 |

| Vermont | Ethan Allen Institute | $146,885 | $170,157 | $90,497 |

| Virginia | Thomas Jefferson Institute | $224,363 | $266,545 | $42,815 |

| Virginia | Virginia Institute for Public Policy | $319,528 | $321,183 | $79,899 |

| Washington | Evergreen Freedom Foundation | $2,338,192 | $2,686,930 | $1,249,633 |

| Washington | Washington Policy Center | $1,149,317 | $1,661,953 | $2,516,590 |

| West Virginia | Public Policy Foundation of West Virginia | $61,183 | $111,282 | $17,522 |

| Wisconsin | MacIver Institute for Public Policy | $584,944 | $384,756 | $370,951 |

| Wisconsin | Wisconsin Policy Research Institute | $884,047 | $670,575 | $2,321,307 |

| Wyoming | Wyoming Liberty Group | $733,133 | $789,044 | -$40,922 |

| TOTAL | SPN + 58 | $64,186,341 | $63,849,013 | $62,003,211 |

(Data is based on organizations' IRS tax filing years, which may or may not correspond to calendar years.)

Articles and Resources

Related SourceWatch Articles

- State Policy Network:

- American Legislative Exchange Council (ALEC)

- DonorsTrust

- Donors Capital Fund

- Koch Family Foundations

- Koch Industries

- Franklin Center for Government and Public Integrity

- Heritage Foundation

- Think tanks

- Whitney Ball

- Adam Meyerson

- Bridgett Wagner

- SPN 2011 Funding

- SPN 2010 Funding

- SPN 2009 Funding

Related PRWatch Articles

- Brendan Fischer, Why Are the Franklin Center's "Wisconsin Reporter" and "Watchdog.org" Attacking the John Doe?, PRWatch.org, December 19, 2013.

- Rebekah Wilce, The State Policy Network's Cozy Relationship with Big Tobacco, PRWatch.org, December 16, 2013.

- Rebekah Wilce, Did ALEC Found SPN? 1991 Report Suggests So, Exposes SPN Agenda, PRWatch.org, December 12, 2013.

- Rebekah Wilce, Guardian Documents Expose State Policy Network Groups' Intent to Lobby, PRWatch.org, December 5, 2013.

- Rebekah Wilce, State Policy Network: The Stealth Network Dramatically Influencing State Law, PRWatch.org, December 5, 2013.

- Rebekah Wilce, Tracie Sharp: Bursar of Mystery Money and "IKEA Model" Materials to Stink Tanks, PRWatch.org, November 19, 2013.

- Center for Media and Democracy, Reports Expose Extreme Pressure Groups Masquerading as Think Tanks, press release, November 13, 2013.

- Rebekah Wilce, A Reporters’ Guide to the "State Policy Network": the Right-Wing Think Tanks Spinning Disinformation and Pushing the ALEC Agenda in the States, PRWatch.org, April 4, 2013.

- Sara Jerving, ALEC and Heartland Aim to Crush Renewable Energy Standards in the States, PRWatch.org, November 27, 2012.

- Connor Gibson, Meet the Network Hiding the Koch Money: "Donors Trust" and "Donors Capital Fund", PRWatch.org, October 29, 2012.

- Brendan Fischer, Koch-Funded Mackinac Center Brings Wisconsin Act 10 Provisions to ALEC, PRWatch.org, May 2, 2012.

- Sara Jerving, Franklin Center: Right-Wing Funds State News Source, PRWatch.org, October 31, 2011.

External Resources

- Wall Street Journal, The Spoils of the Republican State Conquest, December 9, 2016, archived by CMD here.

- DeSmog Blog, Stink Tanks: Historical Records Reveal State Policy Network Was Created by ALEC, December 9, 2013.

- The Guardian, State conservative groups plan US-wide assault on education, health and tax, December 5, 2013.

- Portland Press Herald, "Washington County residents have mixed reactions to plan to eliminate taxes," December 5, 2013.

- The Texas Observer, "The Money Behind the Fight to Undermine Medicaid," December 5, 2013.

- Media Matters, North Carolina Newspapers Largely Ignore Conservative Funding Of Sham Think Tanks, December 3, 2013.

- Shepherd Express, Masters of Manipulation: Right-wing Billionaires, Corporations and the Bradley Foundation Pay for Junk Studies that Prop up Their Agenda, November 27, 2013.

- "Moyers & Company," How a Shadowy Network of Corporate Front Groups Distorts the Marketplace of Ideas, November 19, 2013.

- MSNBC "Rachel Maddow Show," November 18, 2013.

- Free Speech TV "Ring of Fire," Facebook, Microsoft, AT&T and Others Supporting Right Wing Propaganda Machine, November 18, 2013.

- Topeka Capital-Journal, Trabert dismisses report tying KPI to Koch agenda, November 16, 2013.

- The New Yorker (Jane Mayer), Is IKEA the New Model for the Conservative Movement?, November 15, 2013.

- Salon, Ted Cruz and Koch brothers embroiled in shadowy Tea Party scheme, November 15, 2013.

- St. Louis Business Journal, Beyond Sinquefield: Who else is funding the Show-Me Institute?, November 15, 2013.

- The Guardian, Facebook and Microsoft help fund rightwing lobby network, report finds, November 14, 2013.

- Huffington Post, Meet The Little-Known Network Pushing Ideas For Kochs, ALEC, November 14, 2013.

- CBS St. Louis, Show-Me Institute’s Ties Questioned in New Report, November 14, 2013.

- Talking Points Memo, Florida Conservative Group Helping Muck Up Obamacare In Alaska, November 14, 2013.

- Mint Press News, Reports Reveal SPN’s Secret Corporate Agenda Through Use ‘Expert’ Testimony, November 14, 2013.

- Media Matters, Shadowy Right-Wing Group Generates Media Coverage For Conservative Policy From Coast To Coast, November 14, 2013.

- The Institute for Southern Studies, Are conservative think tanks breaking lobbying laws?, November 14, 2013.

- Nonprofit Quarterly, Corporate Money in Network of Right-Wing State Policy Think Tanks, November 14, 2013.

- The Progressive, Right-Wing Think Tanks Push Privatization in the States, November 13, 2013.

- Politico, Report: Think tanks tied to Kochs, November 13, 2013.

- Lawrence Journal-World, Reports released by progressive groups are critical of Kansas Policy Institute, November 13, 2013.

- Maine Insights, Report: Maine Heritage Policy Center’s funding connection to Koch Brothers, November 13, 2013.

- The Florida Current, Liberal groups bemoan lobbying by conservative think tanks, November 13, 2013.

- The Oregonian, Cascade Policy Institute benefits from secretive donor group but says it operates independently, November 13, 2013.

- Center for Media and Democracy, EXPOSED: The State Policy Network, The Powerful Right-Wing Network Helping to Hijack State Politics and Government, organizational report, November 13, 2013.

- Arizona Working Families and CMD, A Reporter’s Guide to the Goldwater Institute: What Citizens, Policymakers, and Reporters Should Know, organizational report, updated November 13, 2013.

- Progress Florida and CMD, Lawmaking Under the Influence of Very Special Interests: Understand the role of Florida ‘think tanks’ in driving a Koch-fueled, ALEC-allied corporate agenda, organizational report, November 13, 2013.

- Maine's Majority Education Fund, Fooling Maine: How national conservative groups infiltrated Maine politics by founding and funding the Maine Heritage Policy Center, organizational report, November 13, 2013.

- Progress Michigan, Who's Running Michigan? The Far-Right Influence of the Mackinac Center for Public Policy, organizational report, November 13, 2013.

- Alliance for a Better Minnesota, Who's in Charge: How Nationalized Corporate-Run Think Tanks Influence Minnesota Politics, organizational report, November 13, 2013.

- Progress Missouri, What Missourians Need to Know About the Show-Me Institute, organizational report, updated November 13, 2013.

- Granite State Progress, Bad Bartlett: The Josiah Bartlett Center and NH Watchdog Answer the Call of the Koch Brothers, organizational report, November 13, 2013.

- ProgressOhio, Smoke Screen: The Buckeye Institute, organizational report, November 13, 2013.

- Keystone Progress, Think tanks or corporate lobbyist propaganda mills?, organizational report, November 13, 2013.

- Progress Texas, TPPF + ALEC, organizational report, November 13, 2013.

- One Wisconsin Now, S is for Shill: Inside the Bradley Foundation's Attack on Public Education, organizational report, November 13, 2013.

- Muncie Voice, Pence and Right-Wing Are Taking Over Public Education, November 13, 2013.

- The Spokesman-Review, Shawn Vestal: Idaho Freedom Foundation pushes limits of word ‘charity’, November 2, 2013.

- AZ Central, When this ‘watchdog’ pitches, taxpayers strike out, October 12, 2013.

- IndyStar, Daniels says speech to partisan group was a mistake, October 10, 2013.

- Muncie Voice, Indiana Policy Review: Not an Independent News Source, October 2, 2013.

- The Spokesman-Review, Idaho Freedom Foundation's charitable status scrutinized, September 15, 2013.

- CounterSpin, Lee Fang on 'The Right Leans In', April 5, 2013.

- FireDogLake, State Policy Network, an umbrella coordinating ALEC, Heritage, Heartland and others, April 4, 2013.

- Thom Hartmann with Lee Fang on MSNBC, The conservative State Policy Network is sneaking into your state & will change America, March 29, 2013.

- Current TV "War Room", Lee Fang discussing the State Policy Network, March 28, 2013.

- The Nation, The Right Leans In, March 26, 2013.

- Democracy Now, Donors Trust: Little-Known Group Helps Wealthy Backers Fund Right-Wing Agenda in Secret, February 19, 2013.

- Paul Abowd, Center for Public Integrity, Donors use charity to push free-market policies in states, Consider the Source, February 14, 2013.

- John R. Mashey, Fake science, fakexperts, funny finances, free of tax 2, DeSmog Blog report, updated October 23, 2012, p. 74.

- Urban Milwaukee, Stealth Conservatives, October 11, 2012.

- Rome News-Tribune, ANALYSIS: Georgia leaders depend on the same well for ideas, October 2012.

- Andy Kroll, The Right-Wing Network Behind the War on Unions, Mother Jones, April 25, 2011.

- Guidestar, State Policy Network, IRS filings and other organizational information about SPN.

- Center for Policy Alternatives, ALEC and the Extreme Right-Wing Agenda, organizational brochure about ALEC and SPN.

- John J. Miller, Fifty Flowers Bloom: Conservative think tanks — mini–Heritage Foundations — at the state level, National Review, November 19, 2007.

- Bridge Project, State Policy Network, online resource listing grants to SPN and SPN's connections to other groups.

- People for the American Way, State Policy Network, RightWingWatch.org, organizational resource.

- Greenpeace, Koch Industries Climate Denial Front Group: State Policy Network (SPN), organizational resource.

References

- ↑ Ed Pilkington and Suzanne Goldenberg, State conservative groups plan US-wide assault on education, health and tax, The Guardian, December 5, 2013.

- ↑ State Policy Network, 2001 Form 990, organizational annual IRS filing, July 1, 2002.

- ↑ State Policy Network, 2012 Form 990, organizational annual IRS filing, May 6, 2013.

- ↑ State Policy Network, 2016 Form 990, organizational annual IRS filing, Oct 17, 2011

- ↑ John J. Miller, Fifty Flowers Bloom: Conservative think tanks — mini--Heritage Foundations — at the state level, National Review, November 19, 2007.

- ↑ 6.0 6.1 State Policy Network, 2010 funders document, on file with CMD.

- ↑ State Policy Network, 2013 Annual Meeting Agenda, September 24-27, 2013, on file with CMD.

- ↑ Center for Media and Democracy, Koch Family Foundations, SourceWatch.org, accessed December 2012.

- ↑ People for the American Way, State Policy Network, "Right Wing Watch" think tank profile, accessed August 18, 2011.

- ↑ 10.0 10.1 State Policy Network, SPN News, organizational newsletter, Fall 2002.

- ↑ 11.0 11.1 Altria, Recipients.pdf 2012 Recipients of Charitable Contributions from Altria Family of Companies, organizational document, accessed November 2013.

- ↑ 12.0 12.1 Lee Fang, The Right Leans In, The Nation, March 28, 2013.

- ↑ Joshua Slavitt, Director, External Affairs, Philip Morris Management Corp., State Policy Network Annual Meeting Address, October 6, 2001, archived in the Legacy Tobacco Documents Library, accessed November 2013.

- ↑ University of California, San Francisco, Legacy Tobacco Documents Library, academic archive website, accessed November 2013.

- ↑ ProgressOhio and Center for Media and Democracy, Smoke Screen: The Buckeye Institute, organizational report, November 13, 2013.

- ↑ David Owsiany, Cigarette tax spike isn't Ohio's financial solution, Columbus Business First, May 6, 2002.

- ↑ Buckeye Institute, 2009 IRS Form 990, organizational annual IRS filing, September 16, 2010.

- ↑ Columbus bar files lawsuit against smoking ban, Associated Press, September 20, 2009.

- ↑ Claude R. Lambe Foundation, 2002 Form 990, organizational IRS filing, available via Guidestar.org, 2002.

- ↑ Claude R. Lambe Foundation, 2003 Form 990, organizational IRS filing, available via Guidestar.org, 2003.

- ↑ Claude R. Lambe Foundation, 2005 Form 990, organizational IRS filing, available via Guidestar.org, November 15, 2006.

- ↑ Claude R. Lambe Foundation, 2006 Form 990, organizational IRS filing, available via Guidestar.org, November 15, 2007.

- ↑ Lynde and Harry Bradley Foundation, 2010 Form 990, organizational IRS filing, available via Guidestar.org, November 14, 2011.

- ↑ Jaquelin Hume Foundation, 2010 Form 990, organizational IRS filing, available via Guidestar.org, July 7, 2011.

- ↑ Chicago Community Foundation, 2010 Form 990, organizational IRS filing, available via Guidestar.org, August 11, 2011.

- ↑ John R. Mashey, Fake science, fakexperts, funny finances, free of tax 2, DeSmog Blog report, updated October 23, 2012, p. 74.

- ↑ Vanguard Charitable Endowment Program, 2010 Form 990, organizational IRS filing, available via Guidestar.org, November 10, 2011.

- ↑ Gleason Family Foundation, 2010 Form 990, organizational IRS filing, available via Guidestar.org, November 11, 2011.

- ↑ Searle Freedom Trust, 2010 Form 990, organizational IRS filing, available via Guidestar.org, November 15, 2011.

- ↑ Armstrong Foundation, 2010 Form 990, organizational IRS filing, available via Guidestar.org, November 14, 2011.

- ↑ JM Foundation, 2010 Form 990, organizational IRS filing, available via Guidestar.org, November 15, 2011.

- ↑ Roe Foundation, 2010 Form 990, organizational IRS filing, available via Guidestar.org, May 9, 2011.

- ↑ Lovett and Ruth Peters Foundation, Inc., 2010 Form 990, organizational IRS filing, available via Guidestar.org, August 12, 2011.

- ↑ John William Pope Foundation, 2009 Form 990, organizational IRS filing, available via Guidestar.org, November 15, 2010.

- ↑ Lowndes Foundation, 2010 Form 990, organizational IRS filing, available via Guidestar.org, May 9, 2011.

- ↑ FGC Foundation, 2010 Form 990, organizational IRS filing, available via Guidestar.org, December 16, 2010.

- ↑ Chase Foundation of Virginia, 2010 Form 990, organizational IRS filing, available via Guidestar.org, June 7, 2011.

- ↑ Rothschild Art Foundation, 2010 Form 990, organizational IRS filing, available via Guidestar.org, November 8, 2011.

- ↑ Jewish Communal Fund, 2010 Form 990, organizational IRS filing, available via Guidestar.org, May 15, 2012.

- ↑ Silverwing Foundation, 2010 Form 990, organizational IRS filing, available via Guidestar.org, November 9, 2011.

- ↑ A.P. Kirby, Jr. Foundation, [http://www.guidestar.org/FinDocuments/2010/222/922/2010-222922817-078a6c12-F.pdf May 14, 2011.

- ↑ Anna Paulina Foundation, 2010 Form 990, organizational IRS filing, available via Guidestar.org, May 9, 2011.

- ↑ JP Humphreys Foundation, Inc., 2010 Form 990, organizational IRS filing, available via Guidestar.org, December 14, 2010.

- ↑ Pioneer Institute for Public Policy Research, 2007 Form 990, organizational IRS filing, April 28, 2008, Schedule B on file with CMD.

- ↑ 45.0 45.1 Forrest Wilder, Revealed: The Corporations and Billionaires that Fund the Texas Public Policy Foundation, TPPF Donor List, Texas Observer, August 24, 2012.

- ↑ State Policy Network, IRS Form 990, organizational tax filing, May 7, 2011.

- ↑ 47.0 47.1 Paul Abowd, Center for Public Integrity, Donors use charity to push free-market policies in states, Consider the Source (organizational publication), February 14, 2013.

- ↑ Robert Brulle: Inside the Climate Change “Countermovement”, PBS Frontline, October 23, 2012.

- ↑ Center for Media and Democracy, DonorsTrust and Donors Capital Fund Grant Recipients, SourceWatch, accessed November 2013.

- ↑ DonorsTrust, IRS 990s, 2008-2011; and Donors Capital Fund, IRS 990s, 2008-2011. See DonorsTrust and Donors Capital Fund Grant Recipients on SourceWatch.

- ↑ Donors Capital Fund, 2011 IRS Form 990, fund's IRS tax filing, November 14, 2012.

- ↑ Paul Abowd, Donors use charity to push free-market policies in states, Center for Public Integrity, February 14, 2013.

- ↑ 53.0 53.1 John R. Mashey, Fake science, fakexperts, funny finances, free of tax 2, DeSmog Blog report, updated October 23, 2012, p. 74.

- ↑ American Bridge 21st Century Foundation, Funder: Searle Freedom Trust, Bridge Project conservative transparency website, accessed November 2013.

- ↑ American Bridge 21st Century Foundation, Funder: William E. Simon Foundation, Bridge Project conservative transparency website, accessed November 2013.

- ↑ ProPublica 2016 Form 990, annual organizational IRS filing, Oct 11, 2017

- ↑ ProPublica 2015 Form 990, annual organizational IRS filing, Sept 8, 2016.

- ↑ ProPublica 2014 Form 990, annual organizational IRS filing, Sept 19, 2015.

- ↑ ProPublica 2013 Form 990, annual organizational IRS filing, May 13, 2014.

- ↑ State Policy Network, 2012 Form 990, annual organizational IRS filing, May 6, 2013.

- ↑ State Policy Network, 2011 Form 990, form filed with the IRS, Guidestar non-profit organizational profile, accessed November 2012.

- ↑ State Policy Network, 2010 Form 990, form filed with the IRS, Guidestar non-profit organizational profile, accessed August 18, 2011.

- ↑ State Policy Network, 2009 Form 990, form filed with the IRS, Guidestar non-profit organizational profile, accessed November 2012.